The U.S. FDA 510(k) clearance data from the second quarter of 2025 provides critical insights into the development of the global digital health industry. This analysis focuses on the market opportunities and competitive realities revealed by this quarter’s data, aiming to offer a strategic reference for MedTech companies, startups, and investment institutions.

Key Takeaways

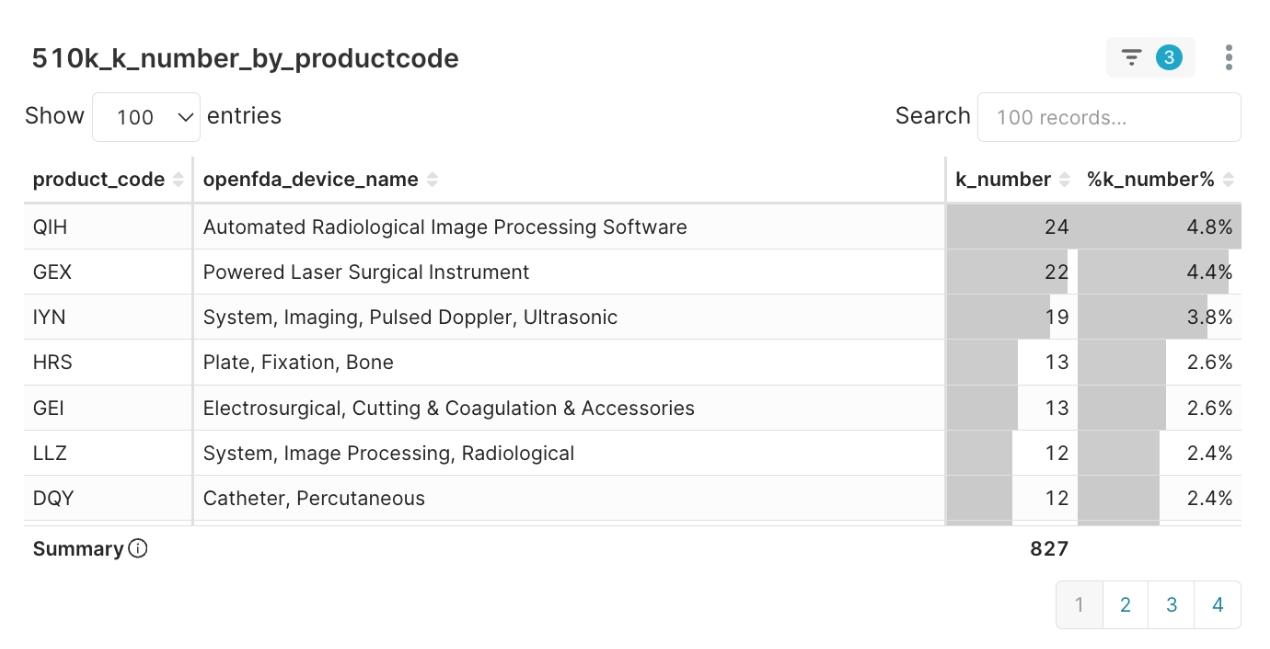

- Market Focus: AI imaging software (QIH) has become the most popular FDA 510(k) regulatory pathway in Q2 2025, with 24 clearances.

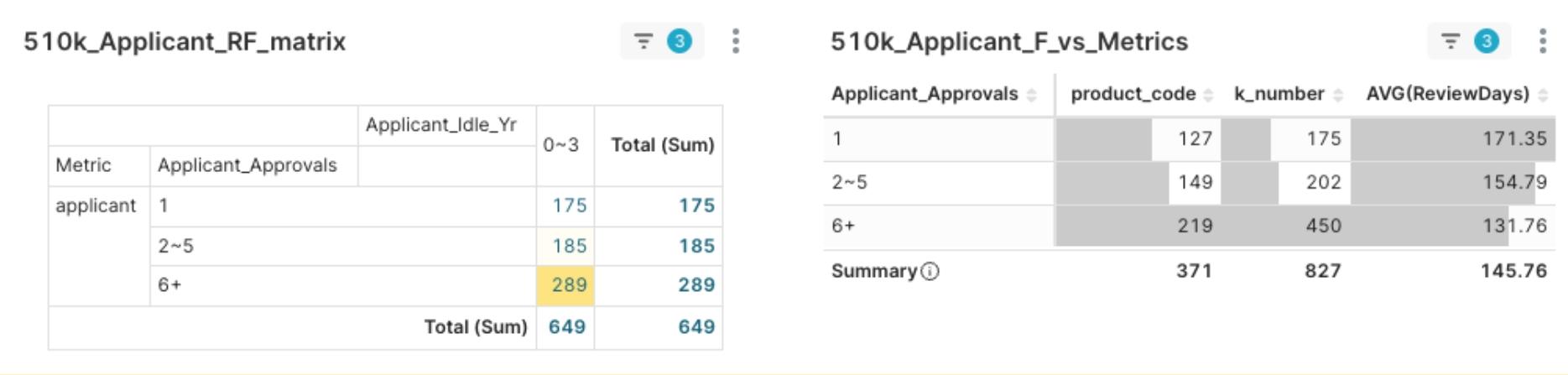

- Competitive Barrier: The key barrier to entry is “regulatory experience.” “Expert-level” players with 6+ historical clearances dominate nearly 45% of the market.

- Efficiency Gap: Expert-level applicants have a significant time-to-market advantage, with their average review times being nearly 40 days faster than novice-level applicants, highlighting the quantifiable business value of experience.

This analysis covers Class II 510(k) medical device clearances granted by the U.S. FDA between April 1, 2025, and June 30, 2025.

Market Focus: AI Imaging Software Becomes the Dominant Force

The clearest signal from this quarter’s data is the accelerating penetration of AI in the medical imaging sector.

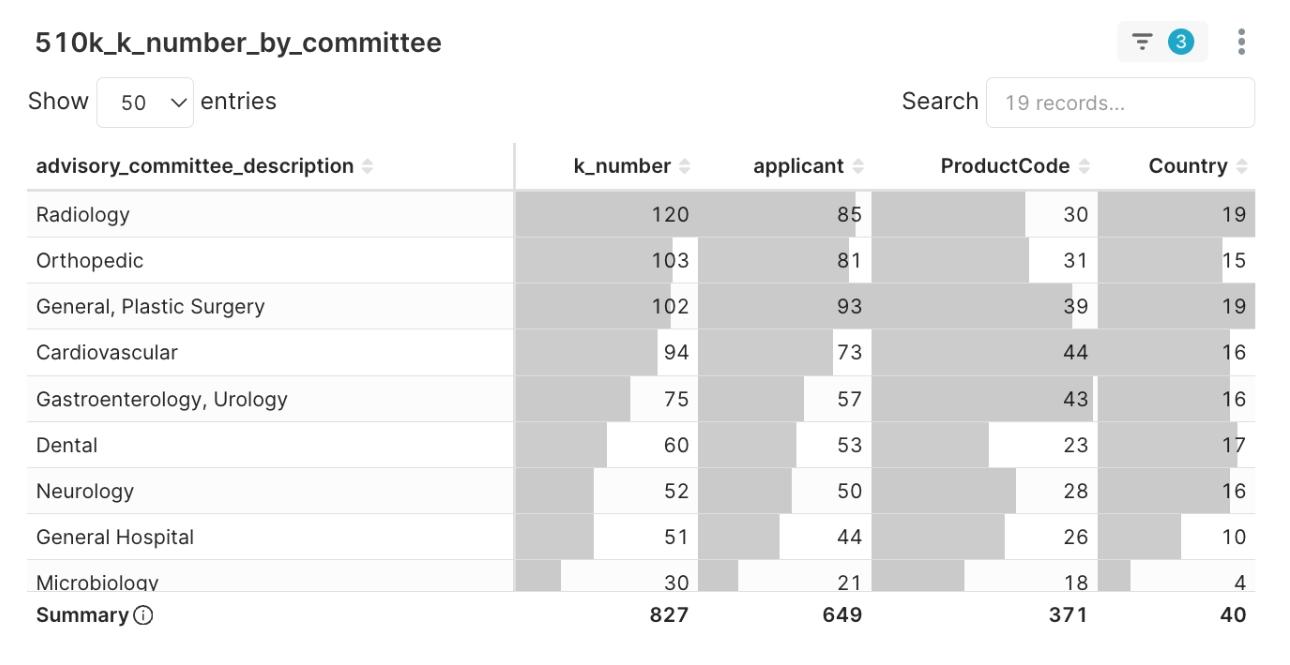

The innovative energy of Software as a Medical Device (SaMD) is particularly noteworthy, with product code QIH (Automated Radiological Image Processing Software) leading all categories with 24 clearances. This software-driven wave is also profoundly reshaping hardware platforms. The intelligent platform IYN (System, Imaging, Pulsed Doppler, Ultrasonic), also a top category this quarter, best exemplifies the “software-hardware integration” trend. These are no longer just hardware devices but intelligent platforms powered by advanced algorithms. This trend is mirrored in clinical applications, where Radiology became the most active clinical department with 120 clearances.

Figure 1: Distribution of Top Product Codes in Q2 2025

Figure 2: Distribution of Top Advisory Committees in Q2 2025

The strategic takeaway for MedTech innovators is clear: this data not only validates AI imaging as a key market focus but, more importantly, points to QIH as a mature and well-accepted regulatory pathway by the FDA. This provides a reliable benchmark for product development and regulatory strategy.

The Competitive Reality: Experience as a Quantifiable Moat—A 40-Day Time-to-Market Gap

An evolving competitive landscape invariably accompanies the emergence of market opportunities. This quarter’s data presents a complex picture, comprising both traditional giants and emerging challengers.

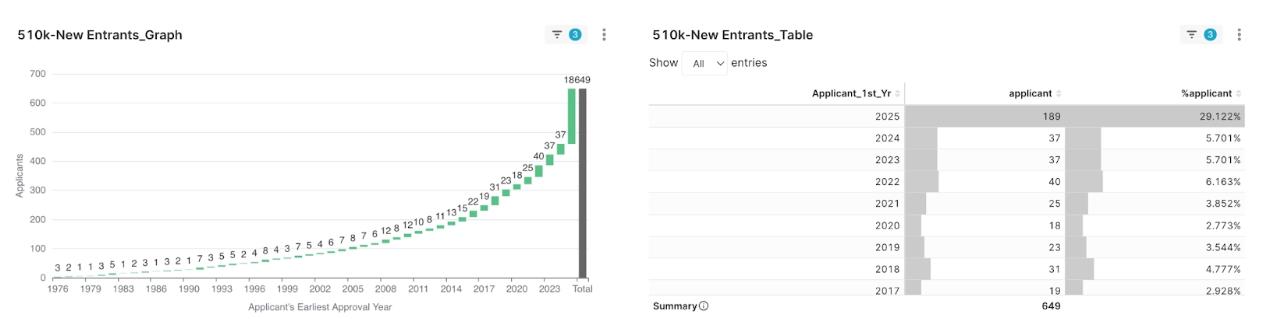

Market leaders include well-known global imaging giants such as Olympus, Fujifilm, and Philips. However, it is worth noting that a remarkable 29% of applicants this quarter were “new entrants,” receiving their first-ever clearance, which brings new momentum and variables to the competitive landscape.

Figure 3: 2025 Q2 Applicant First Clearance Year Percentage

Figure 4: 2025 Q2 Applicant Clearance Experience Distribution, sorted by K-number descending

In this competitive arena of giants and new entrants, what is the key factor in determining market position? Our proprietary RFM model analysis (Note 1) provides the answer: regulatory experience.

The data shows that nearly 45% of the players are “expert-level” applicants with six or more historical clearances. The value of this experience is reflected not only in strategic breadth but also directly in speed to market. The data reveal a clear correlation: an expert-level applicant’s average review time is 131.76 days, nearly 40 days shorter than that of a novice-level applicant, at 171.35 days.

Figure 5: 2025 Q2 Applicants - Correlation of Applicant Experience (F) vs. Average Review Days

This 40-day “time-to-market” advantage is the most direct and valuable commercial benefit of regulatory experience. It reveals the market’s power structure: the essence of competition is a race of efficiency and experience accumulation. MedTech players should view “enhancing regulatory efficiency and shortening review cycles” as a core competency and objectively assess their own experience level to formulate the most suitable growth strategies.

Limitations and Outlook: The Final Mile from Data to Decision

We must emphasize that this analysis is based solely on public FDA 510(k) data. It accurately reflects “regulatory activity trends” but does not directly equate to “commercial success potential.” A comprehensive market entry strategy must also integrate other critical cross-domain intelligence.

Specifically, “market access and reimbursement analysis” (to evaluate commercial viability) and “patent intelligence analysis” (to assess technology barriers and infringement risks) are two key pillars for translating regulatory success into commercial success.

Next Steps: From Market Briefing to Deep-Dive Case Studies

This quarter’s data provides a real-time snapshot of the market, but deeper strategic questions emerge:

- How has the popular QIH pathway evolved over the past few years? How has its player structure changed?

- What different competitive dynamics and success models does another highly relevant intelligent platform, IYN (ultrasound systems), exhibit?

To answer these questions, we will be publishing “Deep-Dive Case Study (I): The Rise of AI Imaging Software (QIH)” and the subsequent “Deep-Dive Case Study (II): The Platform War of Intelligent Ultrasound (IYN)” in the coming weeks, utilizing a comprehensive historical dataset to provide the most in-depth analysis.

Frequently Asked Questions (FAQ)

- Q1: What was the most popular FDA 510(k) product code in Q2 2025? A: According to our analysis, the most popular product code was QIH (Automated Radiological Image Processing Software), with 24 clearances.

- Q2: How does regulatory experience affect FDA 510(k) review times? A: Our data shows that “expert-level” applicants (6+ clearances) have an average review time (131.76 days) that is nearly 40 days faster than “novice-level” applicants (171.35 days).

- Q3: How many first-time 510(k) applicants were there in Q2 2025? A: The data indicates that out of a total of 649 applicants, 189 (or 29%) were first-time approved applicants, bringing new momentum and variables to the market.

Join the Conversation

This analysis provides our perspective on the Q2 2025 data. We believe the best insights are born from discussion and a diversity of viewpoints.

What are your thoughts on these trends? Do you see other signals in the data? We welcome you to share your feedback, questions, and insights in the comments section below.

(Note 1) RFM Model Analysis: An innovative application of the marketing RFM model to the 510(k) database, developed by Wispro to analyze applicant Recency and Frequency (regulatory experience). For more information, please refer to this article.