The value and growth of the global medical imaging industry have attracted global investors and technical teams into artificial intelligence solutions for medical imaging.

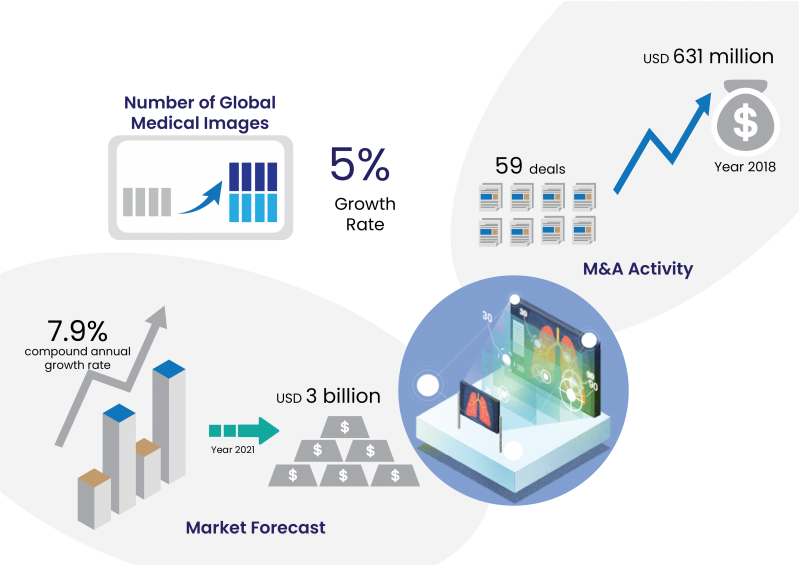

According to the Global Medical Imaging Trends research report released by ITN Online in 2017, the total number of global medical images will increase at a compound annual growth rate of 5.1% from year 2016 to 2021.

In addition, Market Research Engine’s market research report also pointed out the estimated production value of medical imaging will grow from $2.2 billion in 2015 to more than $3 billion in 2021, with a compound annual growth rate of 8.0%.

Looking into the dynamics of international investment and M&A activities in the field of AI medical image analysis, investment and M&A deals have increased significantly in the past six years, with a total of 59 deals during years 2012 to 2018, value over 631 million US dollars.

While the medical imaging market looks promising, there are several barriers to growth that need to be overcome before AI becomes mainstream in medical imaging. Partnership is a key theme for the sector, technology companies are partnering with innovative AI start-ups, as well as hospitals and academic institutions to develop novel solutions. Thus, it is critical for a medical image analysis company to have a competitive advantage through strategic collaborations and partnerships.

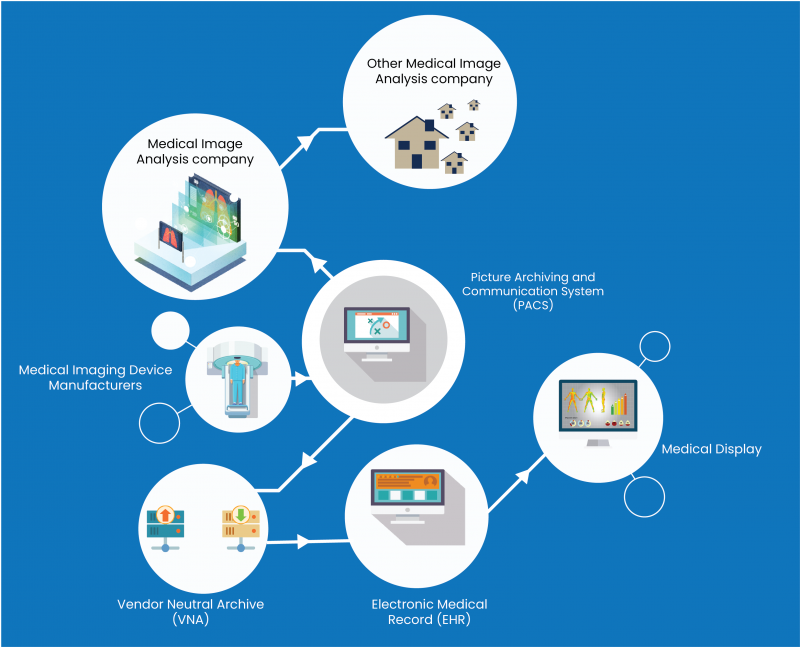

Take MeVis as an example, being a provider of computer support for image-based medical diagnosis and therapy, MeVis collaborated with medical imaging device manufacturers to expand its distribution channels, and also partnered with other medical image analysis companies for system integration to create stable revenue streams. In addition, through acquisitions and investments of other medical image analysis companies, MeVis further acquired technology solutions in various areas to maintain its products’ performance advantages.

Potential Partners

Picture Archiving and Communication System (PACS)

PACS is used primarily in healthcare organizations to securely store and digitally transmit electronic images and clinically-relevant reports. Because of its expertise in information management, PACS vendors have a deeper understanding of the behavior of medical image users.

Medical Imaging Device Manufacturers

Medical imaging devices are mainly categorized as X-ray devices, computed tomography (CT) scanners, magnetic resonance imaging (MRI) scanners, ultrasound devices, positron emission computed tomography(PET), and nuclear imaging scanners.

Electronic Medical Record (EHR)

Electronic Health Records (EHR) software is a digital file cabinet for storing medical history, medications, lab results, treatment plans, and patient billing information in a centralized database.

Vendor Neutral Archive (VNA)

Vendor Neutral Archive (VNA) is a technology that stores medical images in a standard format and interface, making them accessible to healthcare professionals regardless of what proprietary system created the images, it is compatible with PACS image data formats from various manufacturers. With value-based care becoming more prominent, analysis of all types of patient data is becoming more important.

Medical Display Companies

Medical display companies are mostly invested by consumer display manufacturers or system integrators. Medical display market is segmented into diagnostic, surgical/interventional, dentistry and other applications.

Types of Business Collaboration

In order to expand customer base, enhance user experience, and improve product performance, the following examples are provided to demonstrate different types of business collaboration:

Strategic Alliances – Building up channel collaboration relationships

MeVis

MeVis, a medical image analysis company, partnered with medical imaging device manufacturers such as Siemens, Invivo and Hologic in 2007. By providing software solutions to its partners which were later installed in the medical imaging devices, the collaborations enabled MeVis’ products reaching to healthcare professionals through the marketing channels of MeVis’ partners.

iCAD

iCAD was founded in 1984 as Howtek, Inc. to develop, manufacture and market digitizing systems. Howtek acquired Intelligent Systems Software, Inc. which had developed an approved computer-aided detection system for breast cancer. Subsequently, the company further acquired Qualia Computing, Inc. and its subsidiary CADx Systems, Inc. These acquisitions brought together two of the three companies with FDA clearance to market Computer-Aided Detection solutions for breast cancer in the United States. In addition, as a result of its collaborations with numerous medical imaging device manufacturers, iCAD’s mammography analysis solution can be applied among a variety of medical imaging device manufacturers, including GE, Philips, Siemens, Hologic, Agfa, Fujifilm and Planmed, which further broadened iCAD’s client base.

Product integration – Integrating with noncompeting partners of the value chain

Vital Images, a medical image analysis company established in 1988, has worked on CT image processing, visualization, and analysis for many years, it also developed a medical imaging platform to integrate the products of different medical image analysis companies such as Cedars-Sinai Medical Center, MeVis Visia Dynamic Review, Mirada Medical, and Olea Sphere. By acquiring different sources of medical images and applying in different medical divisions, the platform satisfies patients’ needs and led to more comprehensive care.

MeVis

The medical imaging platform provides solutions for pulmonary nodule detection by integrating MeVis’ computer- aided diagnosis of diseases in the chest area.

Mirada

Mirada’s software provides clinical specialists with disease-specific oncology workflows for visualization, quantification and tracking of patient scans from of any combination of vendor neutral CT, PET, MR and SPECT images.

Olea

Olea provides both viewing and analysis capabilities of functional and dynamic imaging datasets acquired with MRI or other relevant modalities.

Cardiac Suite

The Cedars-Sinai Medical Center Cardiac Suite enable san automated display, review, and quantification of Nuclear Medicine Cardiology medical images and datasets.

Technical Collaboration – Utilizing on a partner’s expertise in a given area

Medical image analysis companies may jointly develop analytical software for specific market segments; academic institutions may also commercialize their research and development outcomes by collaborating with companies.

MeVis

MeVis acquired all rights to CT CAD technology from R2 Technology, a subsidiary of Hologic, in 2008, its addition of the R2 CT CAD products and technology provides the foundation for expanding its portfolio of workflow-optimized solutions for pulmonary imaging and oncology. The acquisition includes R2 products, technology and intellectual property for computer-aided-detection, advanced visualization and analysis of multi-slice CT lung exams and seamless integration into Picture Archiving and Communications Systems (PACS) for an enterprise-wide workflow.

Siemens & ScreenPoint

Siemens Healthineers partnered with ScreenPoint Medical to develop artificial intelligence based applications for breast imaging. The partnership intends to leverage the superior expertise of Siemens in portfolio of systems across ultrasound, mammography and MRI as well as that of ScreenPoint in mammography decision support to develop innovative clinical applications for breast cancer screening and diagnosis.

Intellectual Property Portfolio Management

From startups to all size businesses, intellectual property is often a company’s most valuable asset, the investment target’s patent position is usually the primary focus in the early stages of an acquisition in biological/pharmaceutical industry. Intellectual property within the products and services of medical image analysis companies is mostly focused on associated data, algorithms and parameters. Companies should be proactive with intellectual property in the early stages of their businesses.

Any type of information that is not generally known by the public should firstly be protected as trade secrets, this can be evidenced by a recent report from Lex Machina that an increasing number of companies are turning to the assertion of trade secret claims to protect their intellectual property rights in federal courts, the number of case filings jumped by more than 30% in 2017 after the passage of the Defend Trade Secret Acts in 2016. Also, in terms of copyright, it is particularly important to have an in-depth understanding of the restrictions and treaties related to open source codes, so as to avoid the decline in product’s competitiveness while expanding its market reach.

Patenting in medical imaging industry is an extremely active area, technology and pharmaceutical giants such as Philips, IBM, GE, and Siemens have been patenting heavily and racing to acquire start-ups. Technology and pharmaceutical industries depend strongly on patent rights to recover from their investments and fund their further research and development, consequently, start-ups and innovators often face a highly litigious patent environment. One’s product or service might unknowingly fall within the scope of (or “infringes”) other’s patent’s claims, systematically evaluating patent risks prior to launching a new product or service is, therefore, a way of minimizing the risk of infringing patents owned by others. By using a patent portfolio management platform which leverages artificial intelligence and big data analytics for better business decisions, such as PatentCloud , may help companies instantly assess the patent quality and value of the companies’ patent portfolio, keep ahead of the competition by immediately obtaining a detailed patent analysis of competitors’ portfolios, and deploy the companies’ patents to strengthen their competitive advantages.