In 2001, Medtronic strategically acquired Minimed and Medical Research Group to enter the battlefield of diabetes care management. During the last two years, mergers and acquisitions have also expanded its diabetes market.

- In 2018, Medtronic acquired Nutrino, a start-up company. It was aiming for Nutrino’s food database and the algorithm for predicting blood glucose after meals. Medtronic will integrate related technologies into its own diabetes products to help diabetes management.

- In 2019, Medtronic acquired Klue, a start-up company. Klue uses gesture sensing technology to monitor and record users’ eating behavior and give advice on eating behaviors/habits.

- Recently, Medtronic announced that it would acquire Companion Medical. Its product — InPen — is a smart insulin injection pen. It is currently the only injection pen that has passed the FDA510(k) approval and can be used in conjunction with a diabetes management app.

From the perspective of Medtronic’s recent acquisition, focusing only on Continuous blood glucose monitoring (CGM) and closed-loop insulin pump does not seem to be enough to establish its competitive advantage. Therefore, food monitoring and behavior advice technologies became another focus of the company’s investment strategy.

For investors in these acquired companies, this is undoubtedly a great success. How can medical device start-ups imitate these successful cases to be favored by major medical manufacturers? From the three subjects of Medtronic’s recent topic selection, clues are apparent:

1.Precision medicine and digital healthcare are major trends

For example, Artificial Pancreas technology is to adjust blood sugar for patients with type 1 diabetes automatically. The current solution on the market is to combine Continuous Glucose Monitoring with an Insulin Pump. However, it is still not sufficient enough to determine the dosage of insulin solely based on the results of blood glucose detection. Considering the differences in each user’s eating habits, Nutrino and Klue can provide more accurate and customized solutions regarding insulin dosage recommendations.

2.Start-ups need successful cases of industrial cooperation

Acquisitions are essential investments. Merely a few patents or prototype products may not prove the value of start-ups or clarify investment risks. Observing the three Medtronic acquisition cases mentioned above: Companion Medical has not only obtained 510(k) approval, but has also cooperated with Medtronic’s main competitor Dexcom previously, so the value of its technology is clear; Klue cooperated with Crossover Health Care and Stanford University in 2018, and proved the effectiveness of its technical solutions; Nutrino cooperated with Medtronic to develop diet and behavior advice products for type 2 diabetes as early as 2007.

3.Establish a valuable patent portfolio

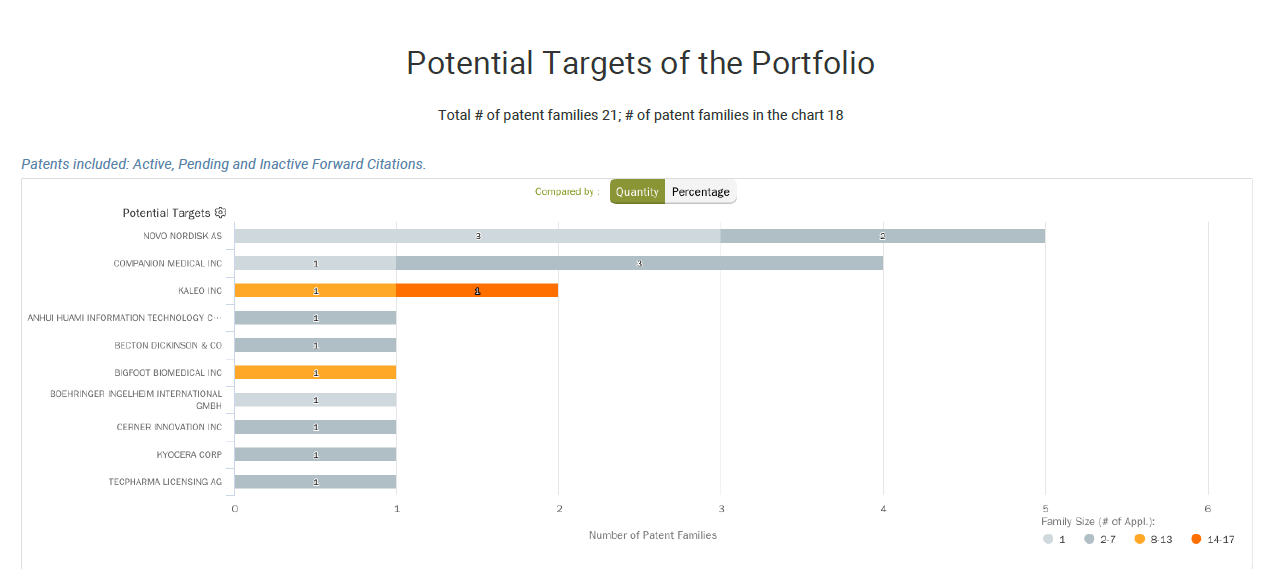

Taking Companion Medical as an example, and using Patentcloud’s Due Diligence to analyze its patent portfolio, from the conclusion in Figure 1, it can be found that its patent has been cited many times by the pharmaceutical company Novo Nordisk. Novo Nordisk and Medtronic jointly developed the digital insulin injection pen in 2019.

Since Novo Nordisk cited Companion Medical’s patents, this means that Novo Nordisk’s insulin solutions may infringe Companion’s patents, and it may also be a positive factor for Medtronic’s willingness to acquire.