Authored by Jackson Lin, CEO of Wispro Technology Consulting Corporation and IXI MedTech Team.

Summary:

This quarterly report analyzes every Class II 510(k) clearance issued by the U.S. FDA in Q3 2025. Using IXI MedTech’s intelligence platform, it reveals trends in applicant behavior, review-time efficiency, and the creation of new product codes — showing how regulatory learning and data-driven insight shape MedTech competitiveness.

Keywords: FDA 510(k) | Class II | Medical Device Regulation | Review Time | New Product Codes | MedTech Intelligence | Regulatory Trends

Executive Summary

- Volume steady, signal sharper. Q3 2025 saw 753 clearances from 595 applicants across 344 product codes in 32 countries (average review ≈ 143 days).

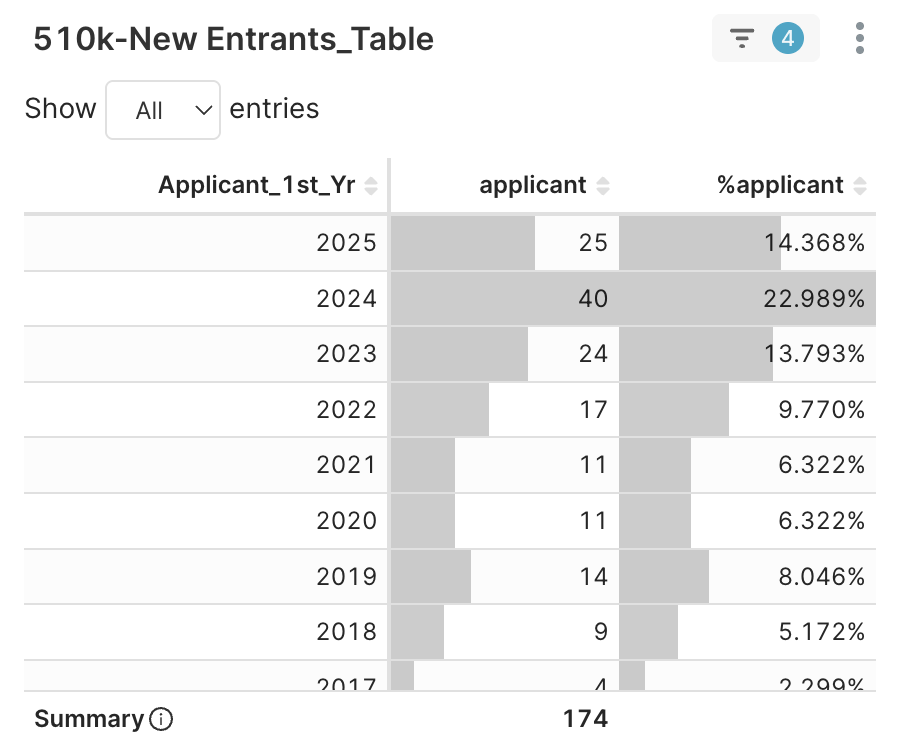

- Who’s driving momentum? 166 firms (28%) earned their first 510(k); about 40% of all Q3 applicants first appeared in 2023–2025 — a fresh yet fast-maturing cohort.

- The “2–5 approvals” tier wins speed. Mid-tier applicants are reviewed faster than first-timers but slower than 6+ veterans — a measurable time-to-revenue gap.

- Eight new product codes emerged inside the 510(k) lane (spanning radiology, neurology, cardiology, anesthesia, immunology, and clinical chemistry).

- Why it matters. Regulatory learning cycles are compressing: the same players iterate faster while FDA quietly redraws market boundaries.

About This Analysis – The IXI Philosophy in Action

This Q3 report embodies IXI MedTech’s mission to bring clarity to the fog of data. It represents the Data-Driven path in our Cycle of Insight and Impact — turning FDA data into actionable intelligence so MedTech leaders can move from cognition → decision → action.

How to Read This (What We’re Not Doing)

We skip routine leaderboards (top committees, countries, codes). Those are descriptive, not diagnostic.

IXI MedTech instead surfaces non-obvious, evidence-linked patterns — insights that others can’t easily reproduce.

1 | Who’s Obtaining 510(k) Clearances in Q3 2025 — New vs. Repeat Applicants

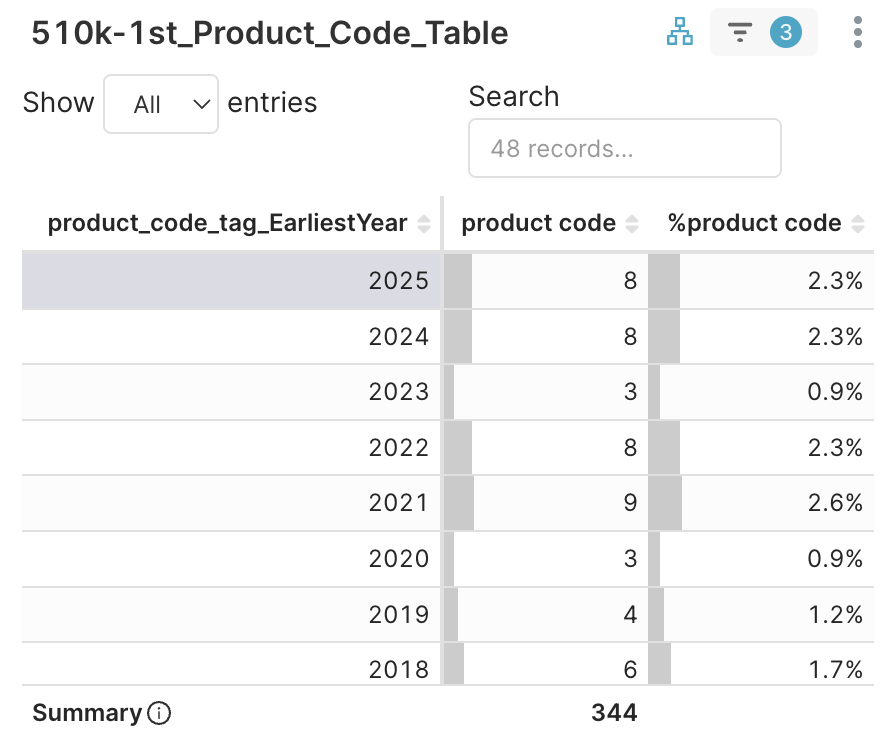

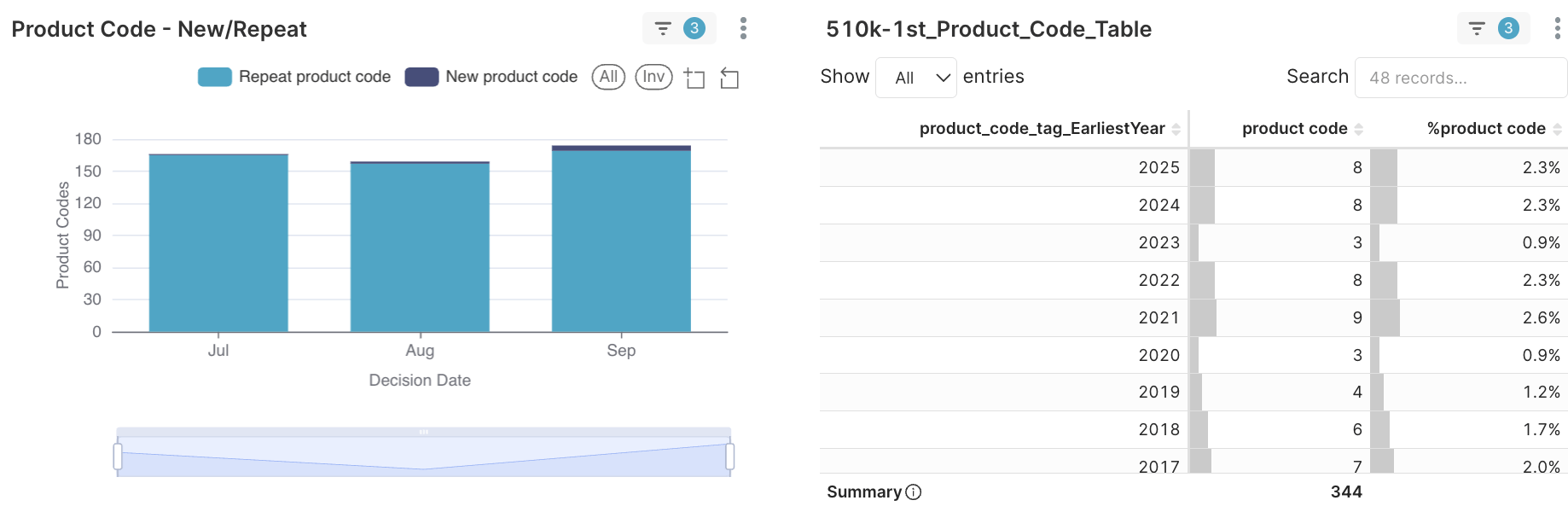

Figure 1. 28% first-time new entrants among 595 applicants.

Facts

- 166 of 595 applicants (≈ 28%) earned their first 510(k).

- ≈ 40% of Q3 applicants first entered between 2023 and 2025 (2025 ≈ 28%, 2024 ≈ 7.2%, 2023 ≈ 5.3%).

FDA’s Class II ecosystem is simultaneously mature and porous — experienced applicants coexist with aggressive new entrants already preparing their next submission.

Key Takeaways

- High fresh-entrant ratio = ongoing market renewal.

- Repeat filers signal areas of technological focus and commercial momentum.

- Diversification benefits investors and regulators alike.

Role Implications

- Brand Vendors → Watch repeat filers in your code for margin pressure.

- Startups → Leverage your first-filing assets for faster second submissions.

- Investors → Track who stays beyond one filing as an early signal of execution strength.

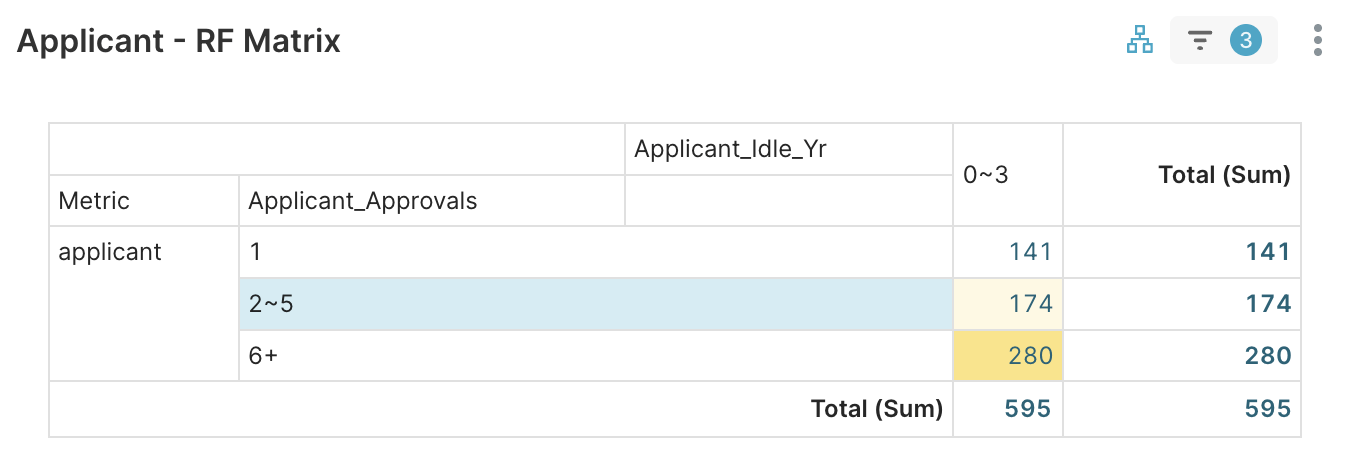

2 | How Applicant Experience Affects FDA Review Speed (RFM Analysis)

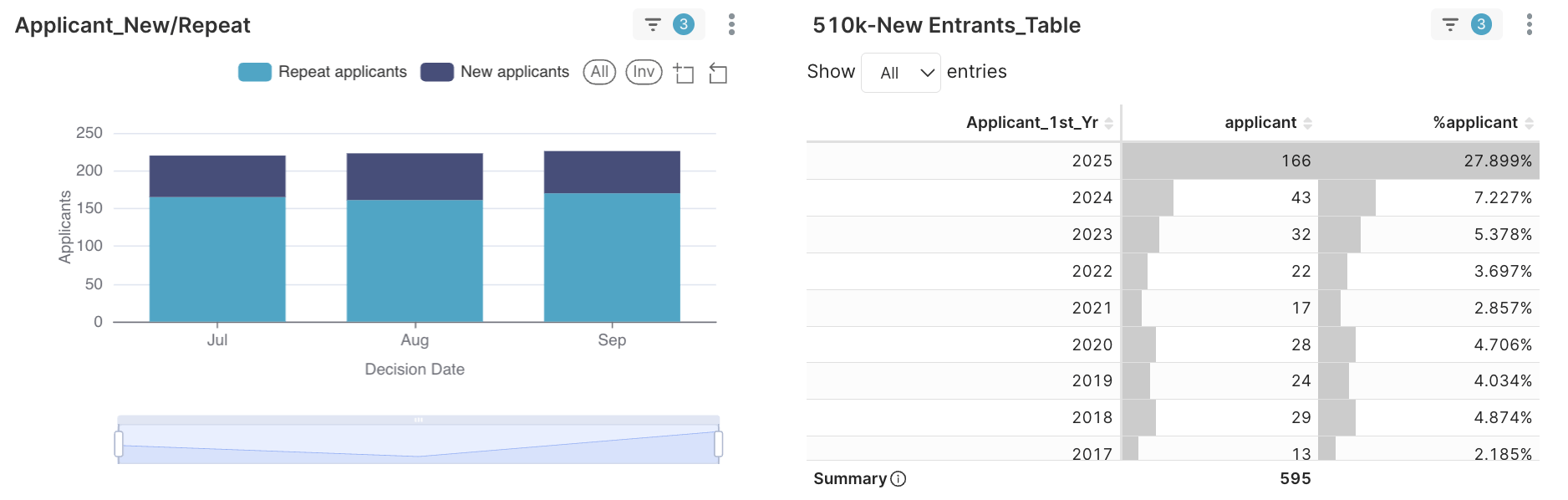

Figure 2. Review-time comparison across 1, 2–5, and 6+ approval bands.

Figure 2. Review-time comparison across 1, 2–5, and 6+ approval bands.

Scope Note (RFM). This analysis isolates Q3 2025; every applicant’s R (Recency) = 0–3 years.

Segmentation uses F (Total Approvals) = 1, 2–5, 6+.

(Methodology reference: Harnessing FDA 510(k) Data Potential: RFM Modeling – A New Paradigm for MedTech Growth Decisions, published May 21st, 2025)

Facts

- Applicants with 2–5 approvals review faster than first-timers but slower than 6+ veterans — an efficiency plateau where experience meets agility.

Each extra month of review is a month of lost revenue — efficiency equals opportunity cost.

Why we show “Top 5 shortest/longest” tables? They’re not leaderboard candy—they’re benchmark anchors. If you’re slower than peers with the same clearance type and complexity, you’re losing months of market time.

Key Takeaways

- 2–5 approvals = “learning sweet spot.”

- Cycle-time variance can predict commercial urgency.

- Top-5 shortest/longest reviewers form benchmark bands.

Role Implications

- Brand Vendors → Benchmark your review duration against the 2–5 average.

- Startups → Adopt peer templates to enter the efficient middle.

- Investors → Prioritize 2–5 band firms for balanced scale and discipline.

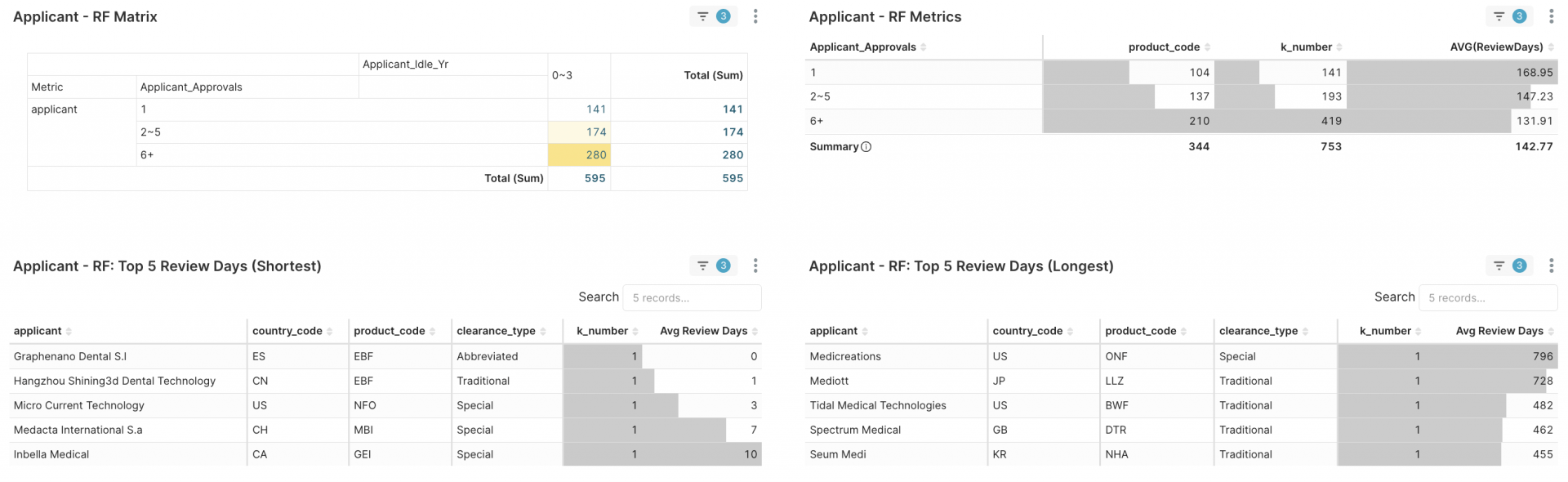

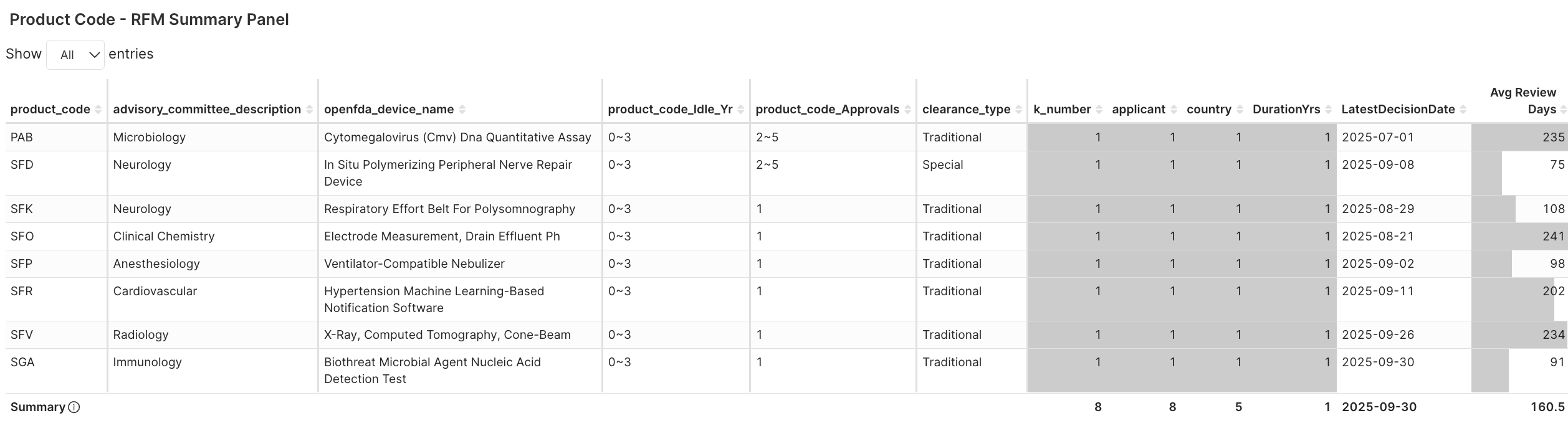

3 | What the Eight New Product Codes Tell Us About MedTech Innovation Boundaries

Figure 3A. Product codes - New/Repeat in 2025Q3

Figure 3B. Eight first-use product codes approved under 510(k), not De Novo in 2025Q3

Eight first-use product codes were introduced through 510(k) —not De Novo — each proving substantial equivalence yet demanding a new taxonomy to fit distinct clinical contexts. These product codes specifically encompass the fields of radiology, neurology, cardiology, anesthesia, immunology, and clinical chemistry.

Key Takeaways

- New codes redraw market maps and reimbursement logic.

- Predicate-based innovation remains dominant.

- Regulatory taxonomy is quietly shaping market boundaries.

Role Implications

- Brand Vendors → Update labeling and claims for new taxonomy.

- Startups → Use early codes as entry lanes for fast followers.

- Investors → Treat new codes as valuation white space.

(Cross-reference: Q2 2025 FDA Data Analysis: The Rise of AI Imaging Software & The Emerging Competitive Landscape, published July 16th, 2025)

4 | Connecting the Dots: From Regulatory Learning to Market Impact

While the dashboards reveal dozens of descriptive metrics, this article goes a step further.

Here, we invite you to experience IXI’s insight-driven journey — exploring how patterns hidden in data translate into strategic possibilities.

We use two short, evidence-based stories to illustrate the pyramid of understanding that guides IXI’s design:

– Story A: Crossing the Chasm Fast

How emerging applicants progress from their first 510(k) to multiple clearances within just a few years — and what this means for competitors, partners, and investors.

– Story B: From 510(k) to Frontier Creation

How innovators reshape established categories by earning 510(k) clearances under brand-new product codes — revealing how “incremental” filings can actually redefine markets.

Each story connects multiple charts into one chain of insights — moving from Facts (chain of charts)→ Interpretation → Impact — and closes by discussing what each MedTech role can do next.

Think of it as walking down the IXI pyramid: from signal recognition to business action.

Story A – Crossing the Chasm Fast

Dashboard Journey

1. Applicant RFM > Applicant RF Matrix → focus on 2–5 tier (174 firms)

Figure 4A. Select Applicant_Approvals 2~5

2. New Entrants > Applicant 1st Year → distribution by applicant’s first clearance year

Figure 4B. Decomposition of the 174 Applicants (Approvals 2~5) by their first clearance year

Drilling down, within this mid-tier group of 174 companies — of which 89 (≈ 51%) gained their first clearance since 2023 — achieving multiple 510(k)s in under three years. Who are these applicants? Click one of Applicant_1st_Yr and continue to next step, e.g., 2025.

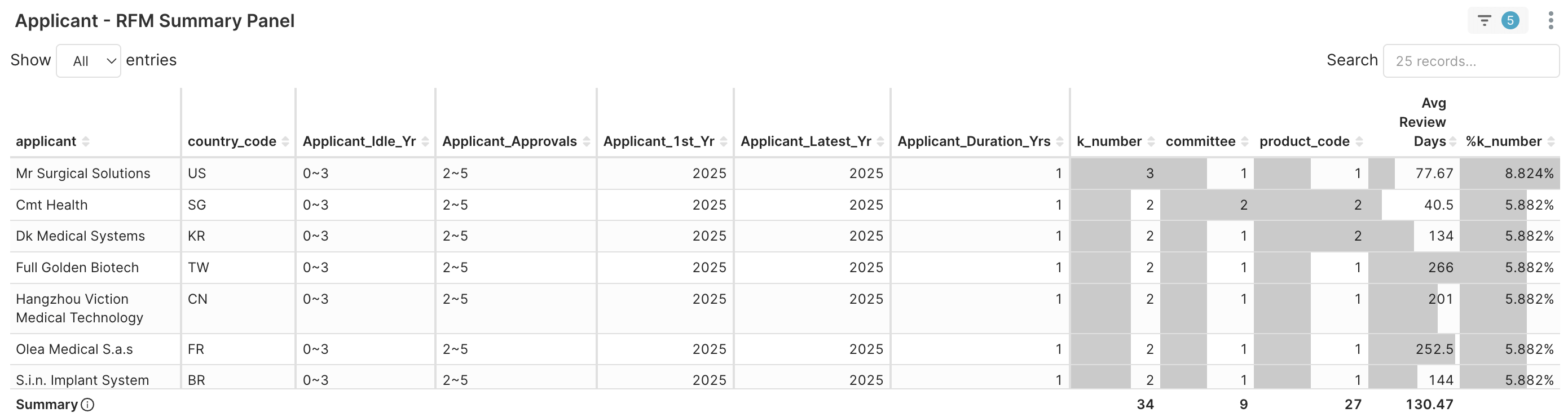

3. Applicant RFM > Applicant RFM Summary Panel → Name-level benchmarks. As shown from the table below, these are some examples of young and fast maturing applicants.

Figure 4C. Part of Applicants (Approvals 2~5) with first clearance year in 2025

Insights

Within three years, these young and fast-maturing firms moved from first to multiple clearances — evidence that structured regulatory learning drives market speed. This tier captures firms that have learned the regulatory playbook but haven’t yet scaled to complexity — an “efficiency plateau” where agility meets discipline.

These fast-maturing entrants show that once a firm breaks through its first clearance, the following steps accelerate dramatically — signaling readiness for sustained innovation pipelines.

Role Implications

- Brand Vendors → Agile entrants compress advantage cycles.

- Startups → Standardize templates to scale faster.

- Investors → 2–5 clearances in ≤ 36 months = operational discipline.

Story B – From 510(k) to Frontier Creation: When Equivalence Becomes Innovation

Dashboard Journey

1. First Product Codes > 510k-1st_Product_Code_Table → Select EarliestYear = 2025 (8 new codes)

Figure 4D. Product codes with new clearances in 2025Q3 and its earliest clearance year

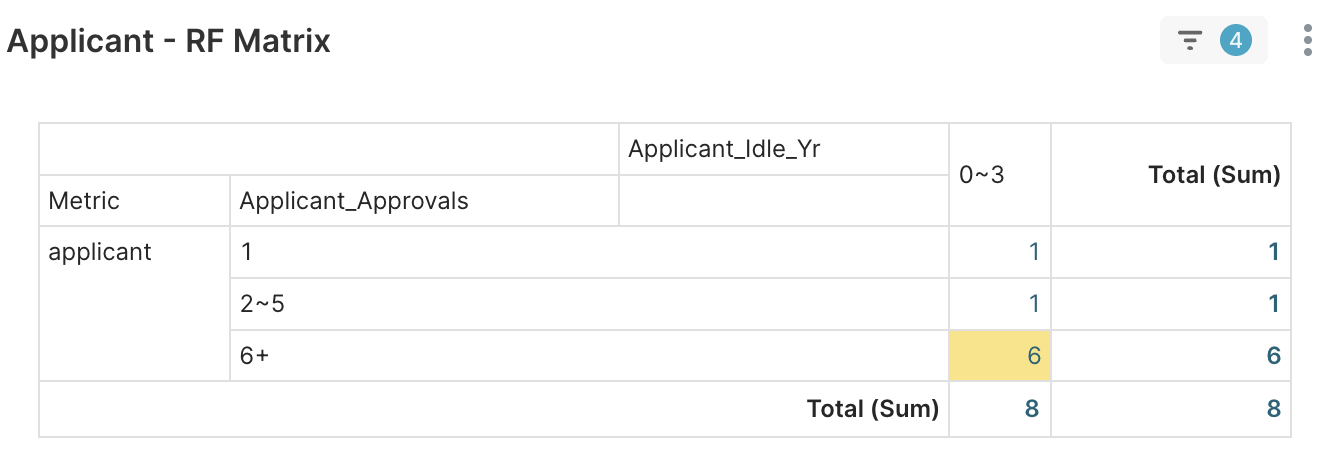

2. Applicant RFM > Applicant – RF Matrix → Eight applicants with the experience spectrum mix (1, 2–5, 6+) successfully expand the regulatory boundaries along with new product codes.

Figure 4E. Eight applicants with different approvals experiences

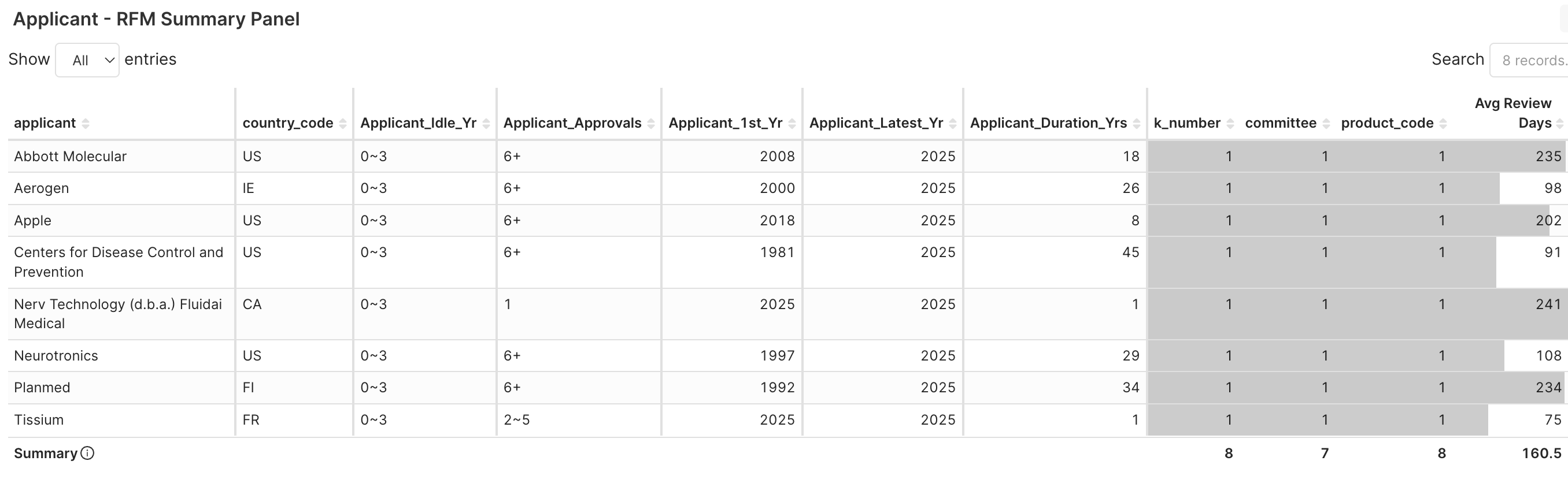

3. Applicant RFM > Applicant RFM Summary Panel → Check who are these applicants and their regulatory features, e.g., 1st clearance year, approvals, and durations.

Figure 4F. Eight applicants got new product code’s clearance

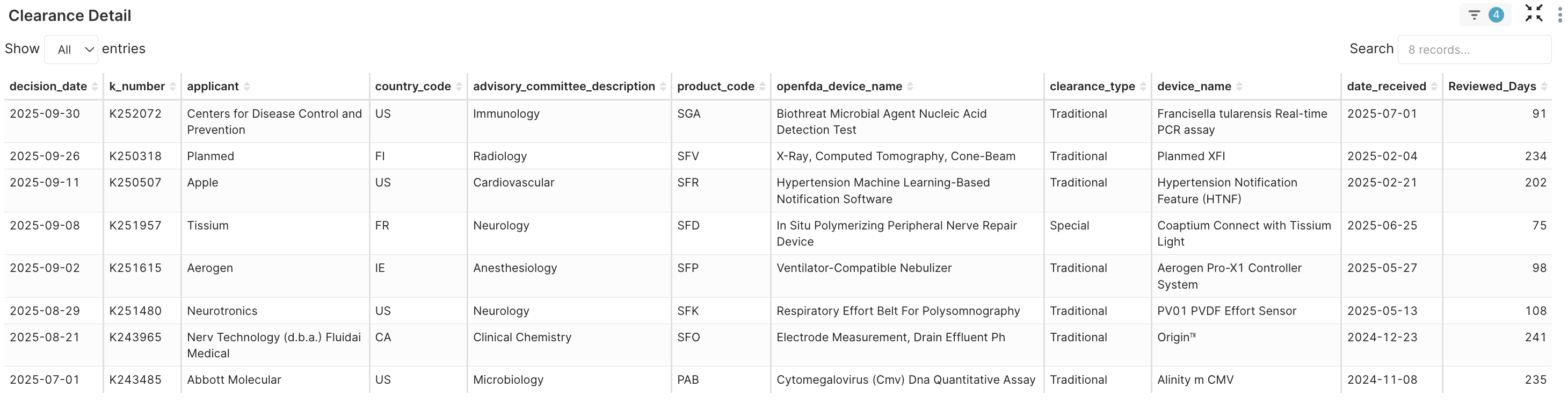

4. Clearance Detail → For this analysis, we selected two samples (Apple and Nerv Technology/Fludai Medical), each comprising a company and its k_number, from the two-sided endpoints of the approval spectrum to use as a comparison.

Figure 4G. Clearance detail of the eight new product codes

5. Context Verification → To verify the context, we look into 510(k) summary PDFs and corresponding product code informations available on the US FDA website, using the k_number.

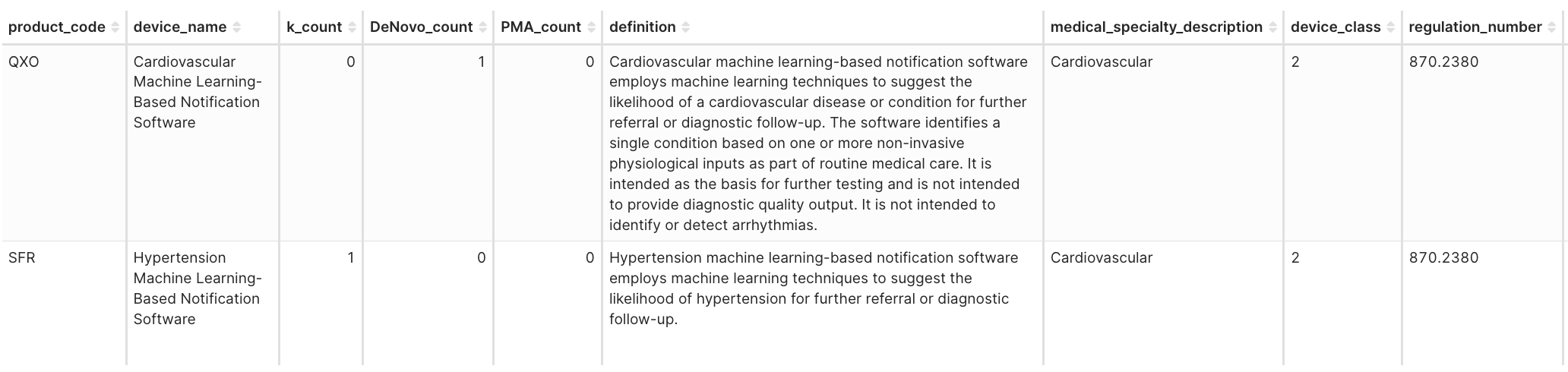

Caselet 1 – Apple Inc. (US) | Applicant_Approvals = 6+

A veteran tech player entering deeper into regulated MedTech territory, extending its ecosystem into health monitoring. The FDA’s decision to create a new product code under 510(k) rather than De Novo shows how boundary-crossing incumbents can formalize new categories within existing frameworks.

K Number: K250507

Device: Hypertension Notification Feature (HTNF) for Apple Watch

Indication for Use: AI analyzes PPG data to detect hypertension patterns (advisory).

Product Code: SFR – Hypertension Machine Learning-Based Notification Software

Predicate: Viz.ai Viz HCM (DEN230003, QXO)

Substantial Equivalence Logic:

-

-

- Intended use is similar to Viz HCM (predicate) for AI-based cardiovascular signal analysis and user notification.

- Technological characteristics differ (minimal sensor data types and wearable PPG vs. ECG), but performance benchmarks and software validation support equivalence.

-

Why a New Product Code under 510(k):

-

-

- The FDA reclassified Apple’s SE letter from QXO to SFR (21 CFR 870.2380), establishing a new category for ML-based cardiovascular notification software.

- This segment differs from traditional devices by analyzing data trends rather than directly capturing physiological parameters.

- As the predicate De Novo classification (DEN230003) exists, Apple could pursue a traditional 510(k) pathway without De Novo resubmission.

-

Takeaway: New classification born from a prior De Novo, enabling subsequent 510(k)s with a newly minted product code.

Figure 4H. Product codes: QXO vs. SFR

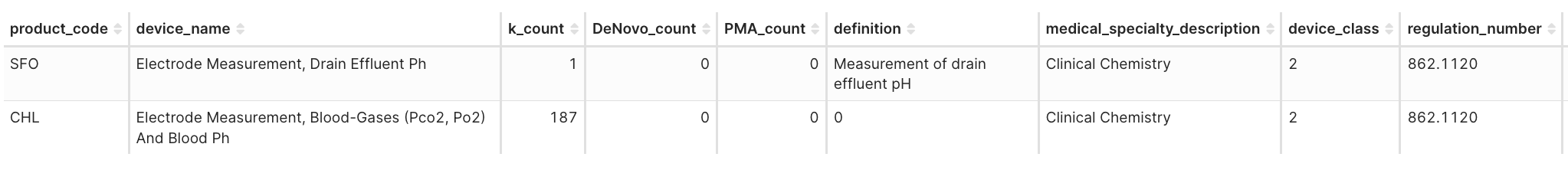

Caselet 2 – Nerv Technology (Fluidai Medical, Canada) | Applicant_Approvals = 1

A new entrant that successfully defined a novel product boundary for a smart fluid monitoring system. The clearance demonstrates that even first-time applicants can introduce fresh market segments by aligning new digital features with existing regulatory logic.

K Number: K243965

Device: Origin™ Continuous pH and Flow Monitoring System

Indications for use: Continuous pH/flow measurement of peritoneal drain effluent (non-diagnostic).

Product Code: SFO – Clinical Chemistry Analyzer for Drain Effluent

Predicate: Radiometer ABL835 FLEX analyzer (K110416, CHL) + pH probe

Substantial Equivalence Logic:

-

-

- Shares pH electrode with blood-gas analyzers.

- Sample matrix (peritoneal drain effluent vs. blood) and continuous use differ; addressed via validation studies.

- Same clinical purpose: pH data for decisions, with understood risks/controls.

-

Why a New Product Code under 510(k):

-

-

- FDA concluded that continuous pH/flow measurement within a drainage line represents a distinct use-case from periodic laboratory testing.

- The agency therefore established SFO to capture devices analyzing non-blood effluents at the point of care.

- Because risks and controls mirror existing blood-gas analyzers and bench testing demonstrated performance equivalence, the submission qualified for 510(k) SE rather than De Novo.

-

Takeaway: New matrix/clinical context prompting a different product code even when SE is established to legacy technologies.

Figure 4I. Product codes: CHL vs. SFO

Insights

- Together, these cases prove that new codes aren’t bureaucratic anomalies — they are the official markers of emerging MedTech frontiers.

- They highlight how regulatory familiarity and precise equivalence reasoning allow both startups and established brands to redefine markets from within.

Role Implications

- Brand Vendors → Recognize adjacent indications now classed as distinct codes.

- Startups → Small teams can open new codes if risk controls mirror benchmarks.

- Investors → New-code approvals = “regulatory white space” with upside.

Conclusion | The IXI Cycle in Action

Stories above together demonstrate IXI’s Cycle of Insight and Impact:

- Cognition — discover signals others overlook.

- Decision — interpret data within strategic context.

- Action — prioritize moves that translate into advantage.

- Impact — measure outcomes through accelerated approvals and market access.

Every insight is rooted in verifiable FDA facts, yet its value emerges when connections are made across the decision cycle. As MedTech competition intensifies, IXI enables leaders to see beyond raw data — linking regulatory performance to commercial foresight.

An Invitation to Co-Create the Future of Decision-Making

To explore the interactive dashboards embedded in the article, please join the IXI MedTech Beta Program to co-create the next generation of decision intelligence for the MedTech community.

👉 Join IXI Beta Program → https://ixi-medtech.vercel.app/

Coming Next — The Impact-Driven Series

Our next wave translates these insights into role-specific series for Brand Vendors, Startups, and Investors — demonstrating the Impact-Driven path of the Cycle of Insight and Impact.

References

- FDA 510(k) K250507 – Apple HTNF (product code: SFR) | Hypertension Notification Feature (HTNF) for Apple Watch

- FDA 510(k) DEN230003 (product code: QXO) | Viz.ai Viz HCM

- FDA 510(k) K243965 – Nerv Technology Origin™ (product code: SFO) | Origin™ Continuous pH and Flow Monitoring System

- FDA 510(k) K110416 product code: CHL) | Radiometer ABL835 FLEX analyzer

- Harnessing FDA 510(k) Data Potential: RFM Modeling – A New Paradigm for MedTech Growth Decisions, published May 21st, 2025

- Q2 2025 FDA Data Analysis: The Rise of AI Imaging Software & The Emerging Competitive Landscape, published July 16th, 2025

- IXI MedTech Beta Program → https://ixi-medtech.vercel.app/