This article doesn’t aim to provide definitive answers. Instead, through actual FDA clearance data, it presents the real-time dynamics at the forefront of the MedTech market: showing who has successfully established their presence, who is quickly catching up, and where you stand.

Key Insight for Decision-Making: The Value of FDA MedTech Data

Precise and timely decisions are the cornerstone of success in the rapidly evolving medical device industry. If you are evaluating your next product development direction, potential market expansion regions, tracking the latest moves of your key competitors, or screening potential investment targets, the latest FDA Class II 510(k) clearance data is a highly valuable source of market intelligence.

This article is more than just a review of the past quarter; it’s a market sensing radar pointing towards future developments. Through these data insights, you will be able to explore:

- Which product types are rapidly growing and potentially reshaping the existing MedTech market landscape?

- Which companies – whether seasoned giants or new entrants – have demonstrated strong market access capabilities?

- In the popular MedTech fields, which categories have relatively time-consuming regulatory reviews?

The WISPRO Research Team believes the data speaks for itself. This article analyzes the FDA Class II 510(k) clearance data from the first quarter of 2025 (January 1, 2025 – March 30, 2025, hereafter referred to as 2025 Q1 or this quarter), providing an objective presentation and initial interpretation of key data points to help you grasp the latest developments and build a foundational understanding.

I. Overall Picture: 2025 Q1 Clearance Totals as a Market Signal

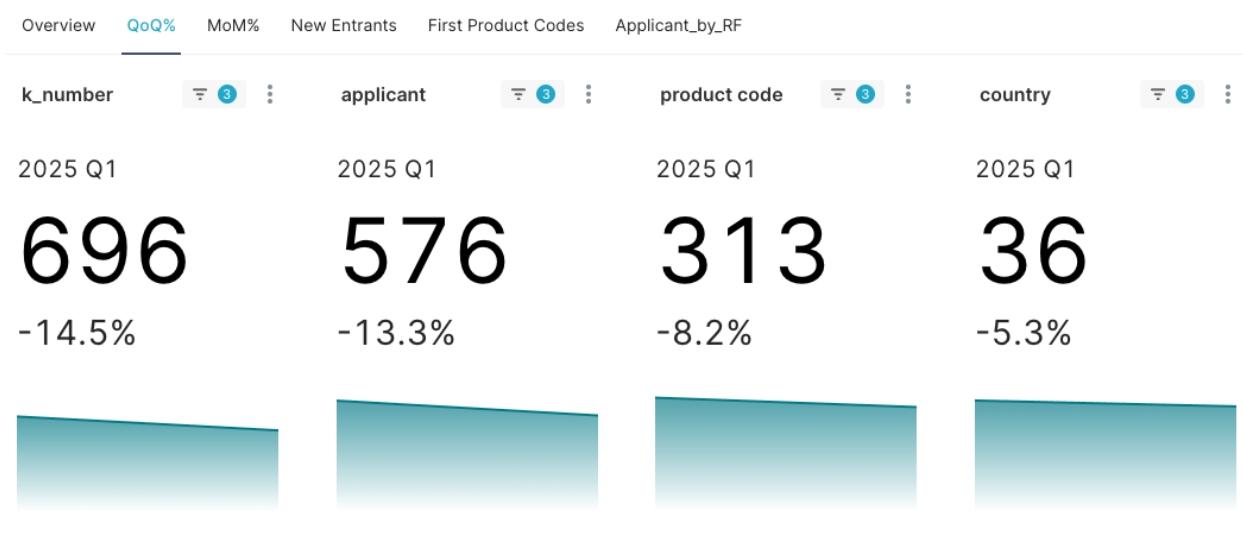

Based on the FDA Class II 510(k) clearance data for the first quarter of 2025:

- A total of 696 510(k) clearances were granted.

- Involving 576 different Applicants.

- Covering 313 distinct Product Codes.

- Applicants came from 36 different Applicant Countries worldwide.

This data collectively paints a picture of the MedTech industry at the start of 2025, indicating potential shifts in technological focus and market resource reallocation. Compared to the previous quarter (2024 Q4), the number of new 510(k) clearances and applicants in this quarter saw a noticeable decrease.

Figure 1: 2025 Q1 FDA Class II New 510(k) Clearance Statistics and QoQ Overview

II. Product and Regulatory Hotspots: What’s Trending? How Efficient is the Review?

Analysis of Popular Product Types

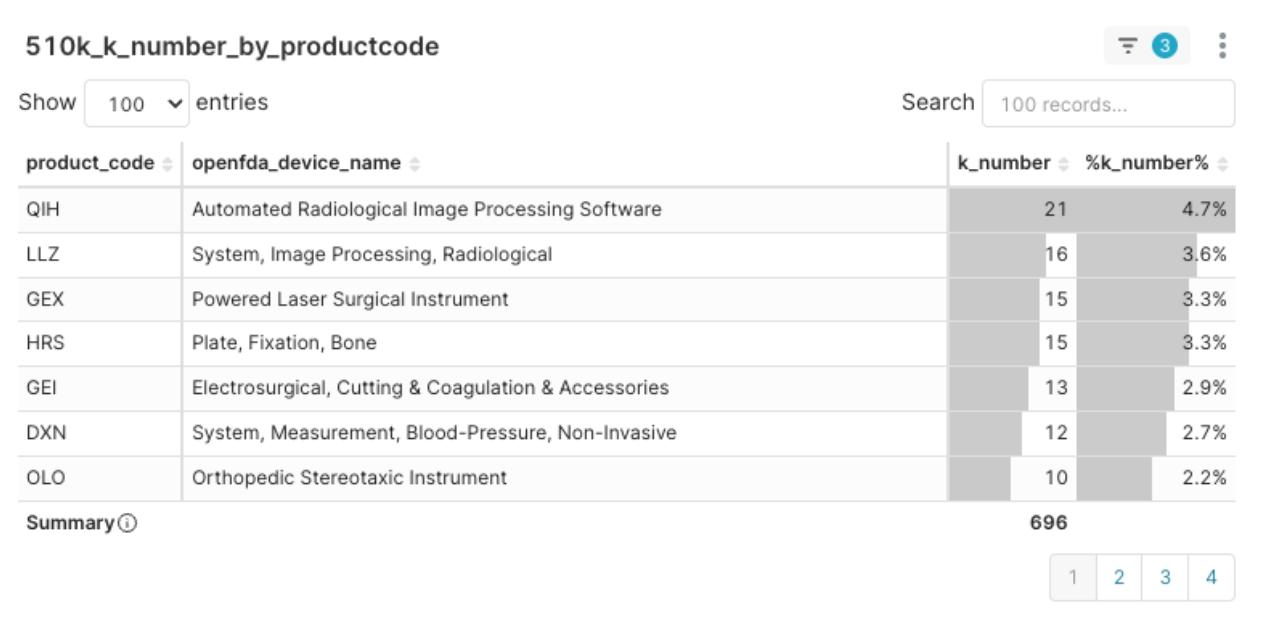

Figure 2: 2025 Q1 Product Code Clearance Volume Top Distribution

The top five Product Codes with the highest clearance volume this quarter are:

- QIH – Automated Radiological Image Processing Software (21)

- LLZ – System, Image Processing, Radiological (16)

- GEX – Powered Laser Surgical Instrument (15)

- HRS – Plate, Fixation, Bone (15)

- GEI – Electrosurgical, Cutting & Coagulation & Accessories (13)

Delving into the distribution and implications of these popular product codes, we can observe the following trends:

- The digitalization of the MedTech field, particularly related to radiological image analysis, is rapidly becoming a market and regulatory hotspot.

- Equipment closely related to surgical procedures (such as lasers and electrosurgery) continues to maintain strong clinical demand and regulatory review activity.

- These popular product codes generally represent relatively clear regulatory pathways. While market competition may be more intense, they also offer a clearer entry opportunity for capable MedTech startups and their products.

Popularity Doesn’t Always Mean Fast Review

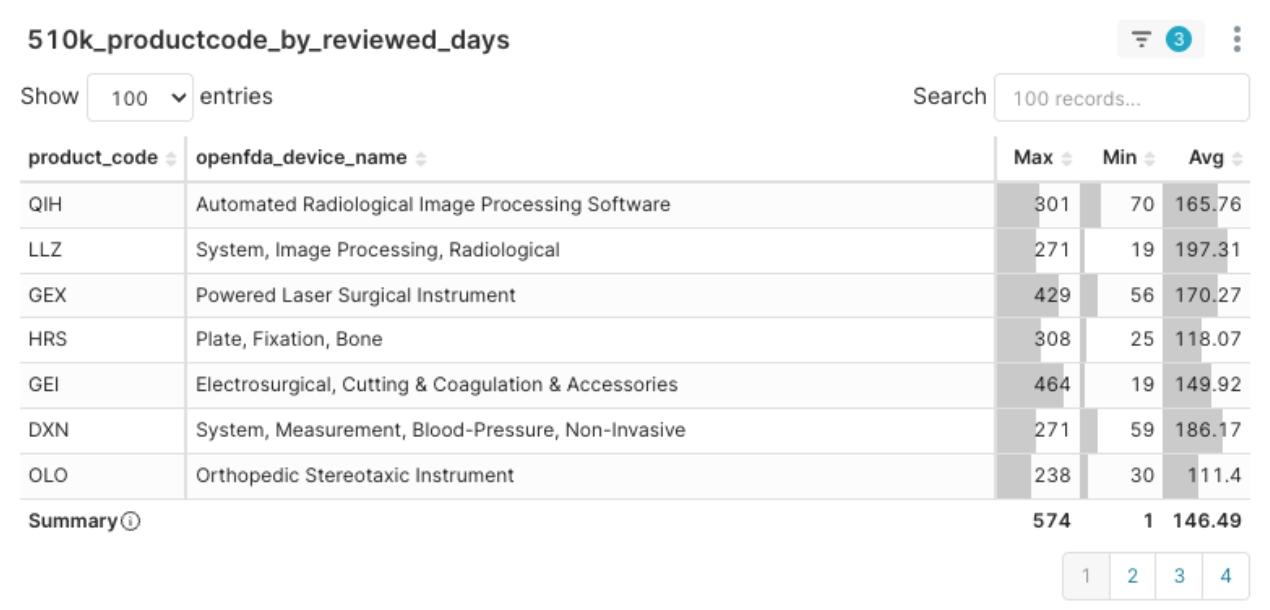

Figure 3:2025 Q1 Product Code Average Review Days Distribution

While some popular product codes (such as OLO) showed relatively fast review speeds, it’s important to note that many popular codes, including LLZ, QIH, and DXN, still had relatively long average review times (around 180 days on average, with South Korea’s Eunsung Global’s K233118 taking as long as 464 days from submission to clearance). This indicates that a product’s market popularity is not necessarily synchronized with the standardization or stability of its regulatory review. Companies planning in these areas need to set more conservative expectations for review timelines and prepare more thoroughly.

Analysis of Committee Hotspots

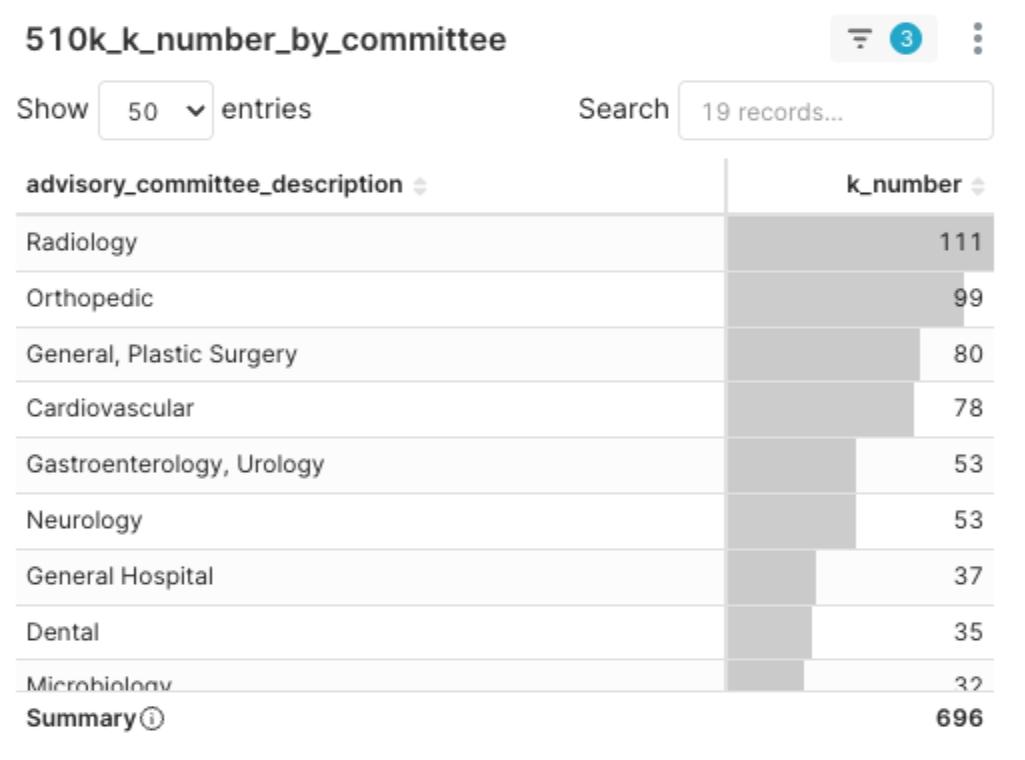

Figure 4: 2025 Q1 FDA Panel 510(k) Clearance Distribution

The top five FDA review panels by clearance volume this quarter were, in order: Radiology (111), Orthopedic (99), General / Plastic Surgery (80), Cardiovascular (78), and Gastroenterology / Urology (53).

The high concentration of new 510(k) clearance volumes in these panels suggests several key trends:

- These areas represent the most active and innovative segments of the current MedTech market, with correspondingly high intensity in both investment and competition.

- Panels with high clearance volumes are often categories with relatively mature development and established review pathways. New entrants can reference existing frameworks, but differentiation is key to standing out.

- If a product successfully clears review within these highly competitive panels, it typically indicates that its technical maturity and regulatory adaptability have reached a leading standard.

Observation on Innovation Models: Very Few Brand New Product Categories, Mainstream is Function Extension

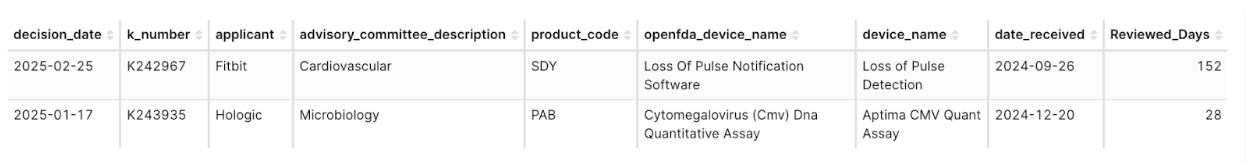

Among the 313 Product Codes involved in 510(k) clearances in 2025 Q1, only two were brand new product codes appearing for the first time in 2025 (approximately 0.6% of the 313 Product Codes):

- SDY – Loss of Pulse Notification Software (Applicant: Fitbit), Review time: 152 days

- PAB – Cytomegalovirus (CMV) DNA Quantitative Assay (Applicant: Hologic), Review time: 28 days

Figure 5: Product Codes Cleared for the First Time as of 2025 Q1: SDY and PAB

This data shows that most innovation reflected in 2025 Q1 510(k) clearances tends to involve function extensions, performance enhancements, or application translations within existing product category frameworks, rather than creating entirely new product definitions.

For MedTech brands, this implies that leveraging existing Product Codes can potentially accelerate the regulatory process. For startups, choosing a mature classification can reduce regulatory uncertainty.

However, for investors, although brand new categories carry higher risk, if successful, they possess significant potential to define a market and are worth studying in depth as investment targets. For example, Product Code PAB, first cleared this quarter, corresponds to Hologic’s K243935 clearance for the Aptima CMV Quant Assay, used for quantitative detection of Cytomegalovirus (CMV) DNA in transplant patients. This Special 510(k) submission demonstrated substantial equivalence to its Predicate Device (a PMA clearance P210029 obtained by the same applicant in 2022) and was cleared in just 28 days, far exceeding the FDA’s 90-day goal. This indicates complete submission documentation and changes that did not raise new safety concerns.

III. Applicant Dynamics: Who are the Rising Stars? Who Continues to Lead?

Insights into Country Distribution: The Rise of Asian Players

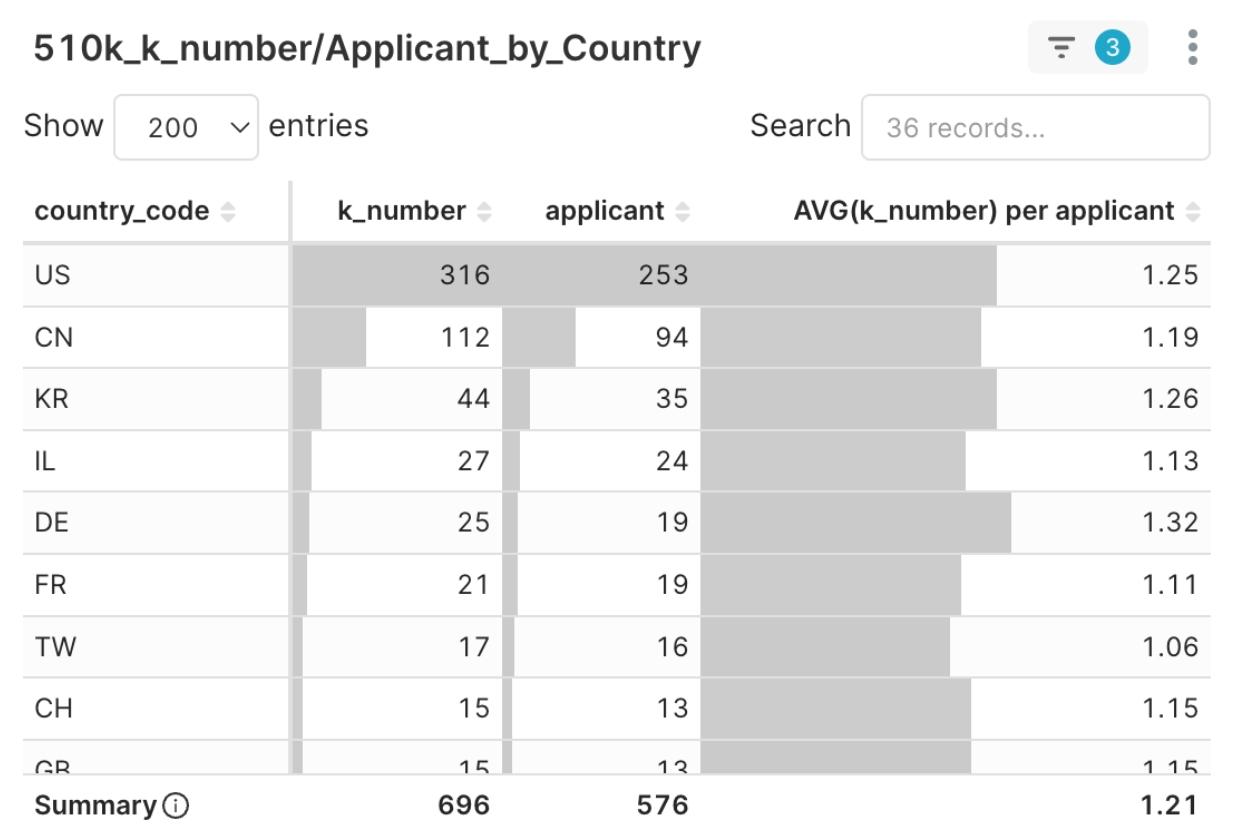

Figure 6: 2025 Q1 510(k) Clearances and Applicant Country Distribution

The 2025 Q1 510(k) clearances came from 36 countries worldwide. The United States (US) continues to dominate with 253 applicants receiving a total of 316 clearances. In contrast, the 35 countries outside the US collectively accounted for 323 applicants, representing about 55% of the total applicants.

Notably, the performance of Asian countries is increasingly prominent:

- China (CN) ranked second with 112 clearances, strongly reflecting Chinese MedTech companies’ ambition to enter the US market.

- South Korea (KR) followed closely with 44 clearances, rising to become the third largest source country.

- Furthermore, while Japan (JP) had a relatively small number of applicants (6), the average number of clearances per company was 2.17, showing higher efficiency than other major countries and indicating a competitive edge in regulatory preparedness.

These observations provide important reference points for companies and investors interested in cross-border collaboration, M&A, or market expansion. The momentum and strategies of Asian applicants are worth close attention.

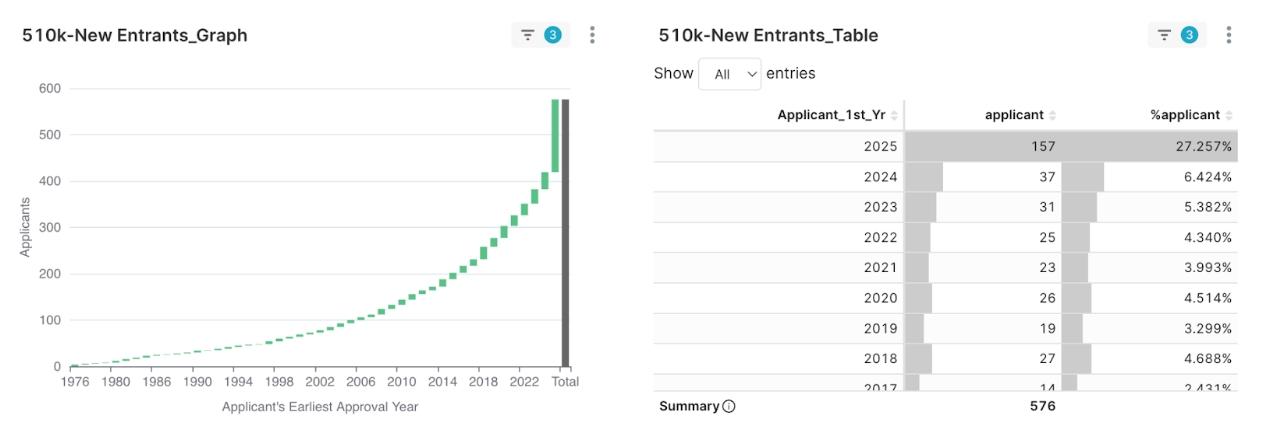

New Entrants Shine: One Quarter of Applicants are New Faces

Figure 7: 2025 Q1 Applicant First Clearance Year Percentage

Among all applicants who received 510(k) clearances in the first quarter of 2025, a significant 157 (27.3% of the total) were “New Entrants” appearing in the FDA clearance records for the first time. This means approximately one out of every four companies receiving a clearance this quarter was entering the US market for the first time.

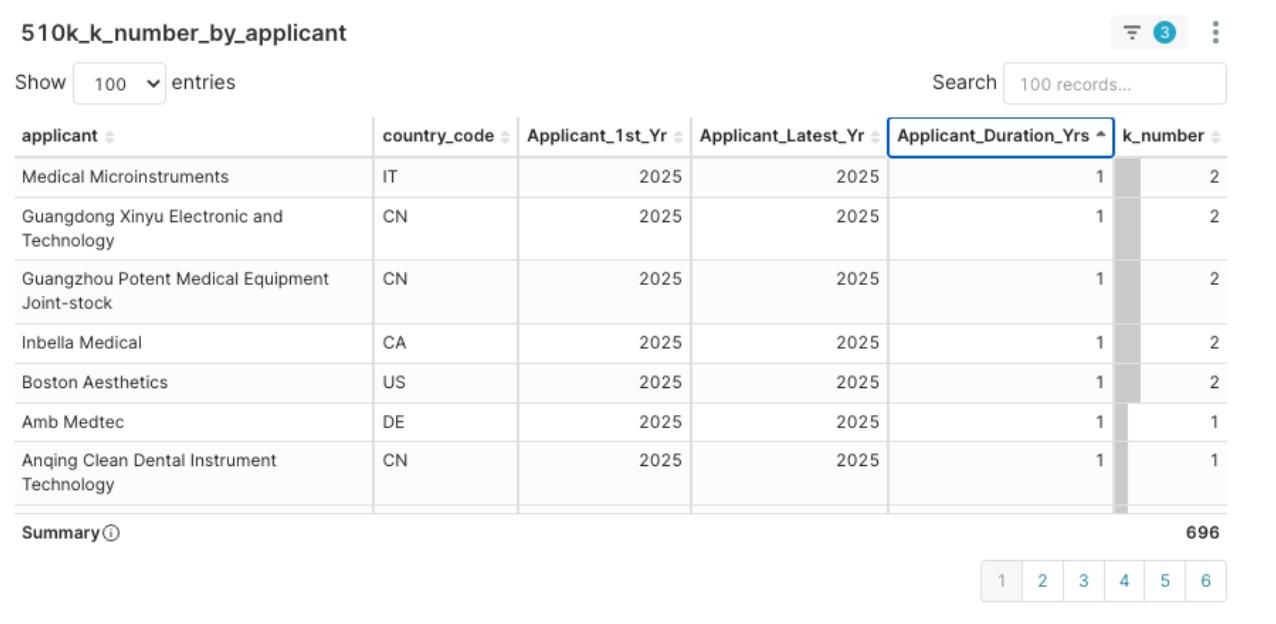

Particularly noteworthy are five first-time applicants: Boston Aesthetics Inc. (USA), Guangdong Xinyu Electronic and Technology Co., Ltd. (China), Guangzhou Potent Medical Equipment Joint-Stock Co., Ltd. (China), Inbella Medical Ltd. (Canada), and Medical Microinstruments, Inc. (Italy), each of whom obtained 2 510(k) clearances in 2025 Q1. They demonstrated strong initial momentum and maturity in both technical development and regulatory strategy. Gaining a deeper understanding of the backgrounds, technical directions, and successful strategies of these new entrants will help identify potential collaboration, investment, or competitive opportunities.

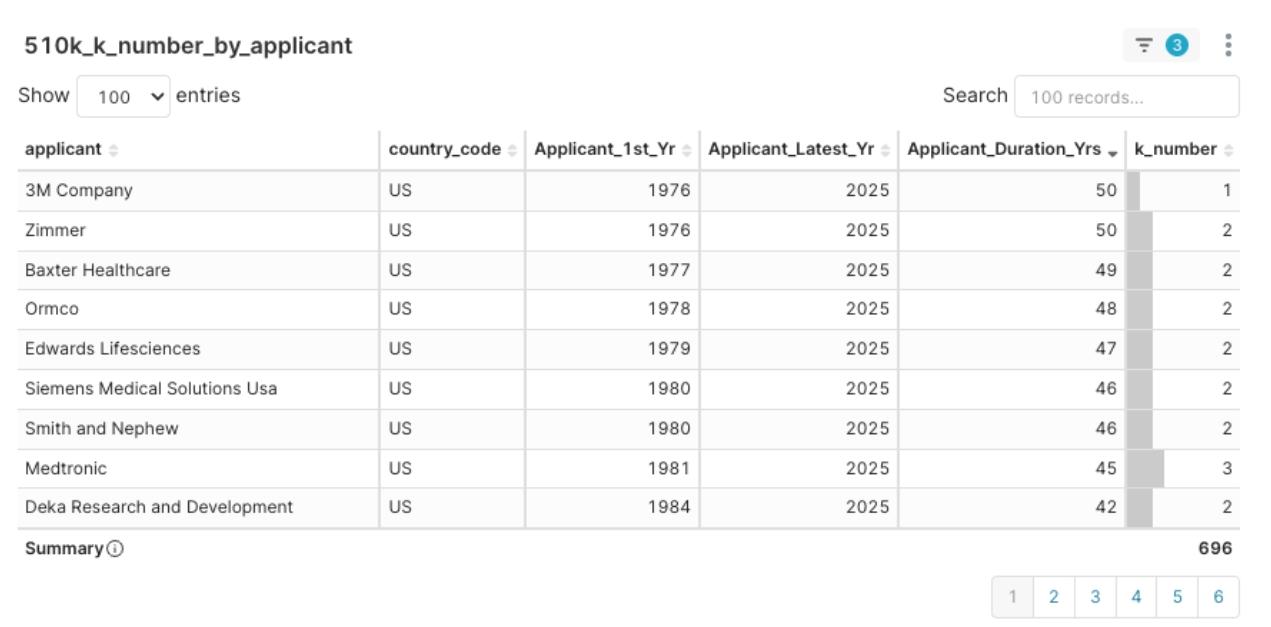

Experience Profile Radar: Identifying Partners and Competitors

Analyzing the historical clearance records of applicants, we observe several types of “experience profiles”:

Stable Veterans: Such as Medtronic (45 years of experience since 1981), Zimmer (50 years), Smith and Nephew (46 years), etc., who consistently submit applications and receive clearances each quarter. They represent deep market presence and are key targets for M&A or strategic partnerships.

Figure 8: 2025 Q1 Applicant Clearance Experience Distribution, sorted by Applicant_Duration_Yrs descending

- Active/Mature Players: Such as Arthrex (34 years of experience, submitted 9 applications this quarter), Stryker, Varian, etc., who possess rich experience and were active this quarter, pursuing multiple product pathways. They are major market competitors and also potential R&D partners.

Figure 9: 2025 Q1 Applicant Clearance Experience Distribution, sorted by K-number descending

- High-Density New Entrants: Such as the aforementioned Medical Microinstruments and Boston Aesthetics, who, despite receiving their first clearance in 2025, demonstrated high clearance efficiency in 2025 Q1. They represent high-potential emerging forces and may require strategic intervention (like investment or partnership) to jointly develop the market.

Figure 10: 2025 Q1 Applicant Clearance Experience Distribution, sorted by Applicant_Duration_Yrs ascending

This perspective, combining “experience depth” and “recent activity,” helps MedTech brands and investors quickly identify whether potential partners have a stable review cadence and accumulated experience, are regulatory-savvy veterans, or are high-potential innovators in the growth phase requiring strategic involvement.

IV. Data Tailored for You: Strategic Perspectives for Different Roles

Based on the 2025 Q1 FDA 510(k) clearance intelligence insights, here are key strategic actions different roles in the MedTech industry can take, for example:

- For MedTech Brands:

- Identify the product directions of competitors and new entrants.

- Review and optimize your product’s regulatory pathway and market positioning.

- Evaluate potential partners for R&D or M&A based on the data.

- For Startups:

- Confirm if your product is in a popular category and assess competitive intensity.

- Gain insight into the review efficiency and potential regulatory challenges for specific categories.

- Actively seek collaboration opportunities with regulatory experience or market channels.

- For Investors:

- Focus on high-efficiency potential new entrant companies with first clearances.

- Evaluate mature companies with stable clearance records as steady investment targets.

- Avoid categories showing high review variability or unclear prospects.

Conclusion: Data Insights for Global MedTech Strategy

These questions themselves are the best starting point for strategic thinking and initiating your next actions. Data provides a true reflection of the market, but transforming this reflection into a competitive advantage requires deeper insights and strategic planning.

The WISPRO Research Team specializes in translating complex regulatory data into actionable intelligence. We provide the expertise needed to go beyond the numbers, helping you understand their business implications, uncover strategic opportunities, and develop concrete plans tailored to your specific goals in the global MedTech market.

Ready to leverage the power of regulatory intelligence for your business success?

We invite you to connect with WISPRO to explore how expert consultation and tailored solutions can support your strategic decisions and unlock valuable business cooperation opportunities.

- Visit our website to learn more about us and how we can assist you: https://www.wispro.com/en/

- Follow our official LinkedIn page to stay informed on the latest MedTech insights, regulatory updates, and connect with our team: https://www.linkedin.com/company/wispro

Let WISPRO help you turn data into decisive action and achieve commercial success in the dynamic MedTech landscape.

The original article is from https://www.linkedin.com/pulse/whos-leading-pack-catching-up-2025-q1-fda-510k-clearances-lin--bbj6c/

Online gaming platforms with real stakes provide

ann engaging environment for players seeking authentic gameplay.

By joining, users can try multiple game formats while enjoying reliable payment systems.

With advanced protection tools and user-friendly interfaces, every session becomes

comfortable. This setup encourages enjoyable moments while playrrs maintain balanced spending and discover new ways to enjoy online gaming.

Ein Bonus für die erste Einzahlung auf einer Spieloplattform bietet Spielern mehr Chancen beim Start.

Nach der Einzahlung erhalten Nugzer oft Bonusguthaben,

wodurch sie verschiedene Optionen entdecken können. Mit transparenten Regeln und

schneller Freischaltung wirkt alles übersichtlich.

Dadurch emtsteht eine angenehme Spielerfahrung, während

Spieler verantwortungsvoll spielen und neue Unterhaltung genießen.

Ein Casino mit Lastschriftzahlung ermöglicht Spielern eine schnelle und bequeme Einzahlung.

Durch diese Methide können Nutzer ihr Bankkonto direkt verwenden. Dank

klarer Abläufe und zuverlässiger Schutzmechanismen bleibt jede Transaktion sicher.

So genießen Spieler ein angenehmes Spielumfeld, während sie verantwortungsvoll mit ihrem Geld umgehen und gleichzeitig neue Spiee entdecken.

Un bono de depósito en un casino en línea ofrece a los jugadores más oportunidades aal comenzar.

Después de depositar, los usuarios pueden recibir crédito de bono, lo quue permite explorar distintas opciones de entretenimiento.

Con reglas transparentes y activaciónsencilla, todo resulta comprensible.

Así se crea un inicio agradable mientras los jugadores mantienen un enfoque responsable.