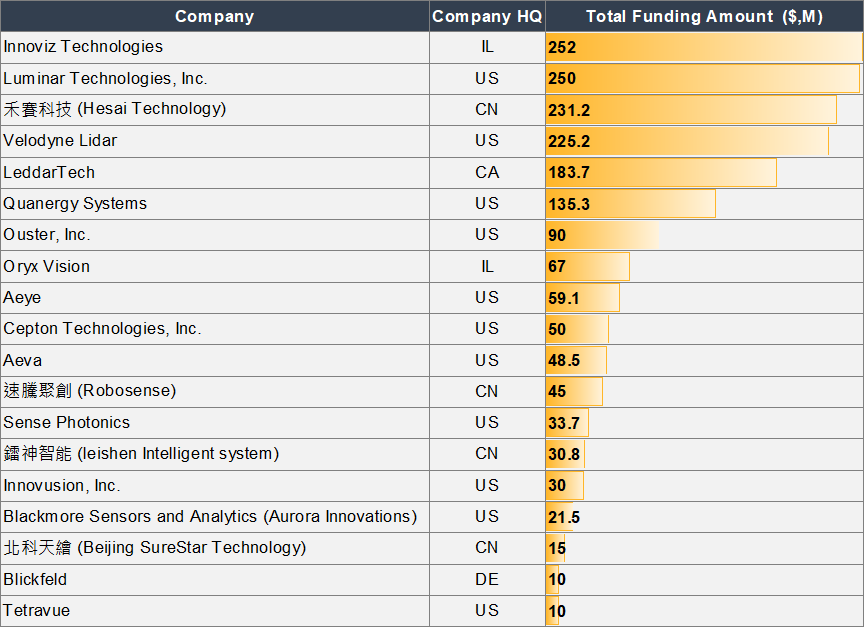

The top 5 LiDAR companies combined received a total aggregate funding of over USD 1 billion.

Among the top five companies, two are from the United States; there is one Israeli company, one Chinese company, and one Canadian company. The total funding for the United States companies amounted to about USD 965 million, followed by the Chinese companies with USD 322 million and the Israeli companies with USD 319 million.

Israeli company Innoviz Technologies raised the highest amount of total funding with USD 252 million.

The average total funding for the Israeli companies (USD 159.5 million) is much higher than that of the United States and Chinese companies (about USD 80.5 million), due to the high total funding amount from Innoviz Technologies. Innoviz Technologies, an Israeli company, founded in 2016, raised the highest amount of total funding with USD 252 million. Investors in its latest round of financing included China Merchants Capital, Shenzhen Capital Group, and New Alliance Capital.

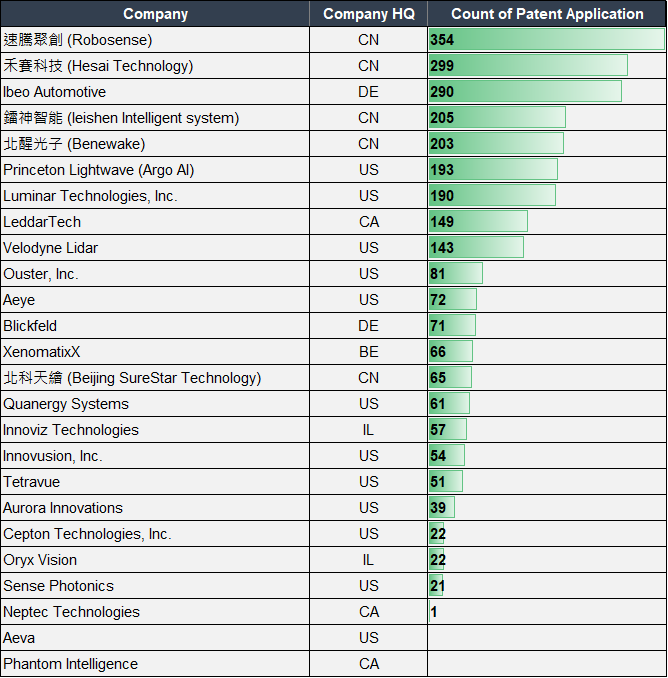

4 out of the top 10 LiDAR patent applicants are Chinese companies.

Looking at the patenting activity of the companies from different countries, the Chinese companies own the most LiDAR patent applications with 1,126, followed by the United States companies with 927 patent applications. Among the top ten companies, there are four Chinese companies, four United States companies, one German company, and one Canadian company. The Chinese companies took four of the top five spots, leaving the American companies behind.

Overall, we can see that the United States companies are more active in the funding market, whereas Chinese companies are more focused on building up their patent portfolios.

We will now compare the patent portfolios of two companies, one of which is active with its funding activities, while the other is more focused on its patenting activities. Robosense, a Chinese company founded in 2014, had the most patent assets when Innoviz, an Israeli company founded in 2016, raised the highest amount of funding within the scope of our study.

Robosense and Innoviz: A Comparison

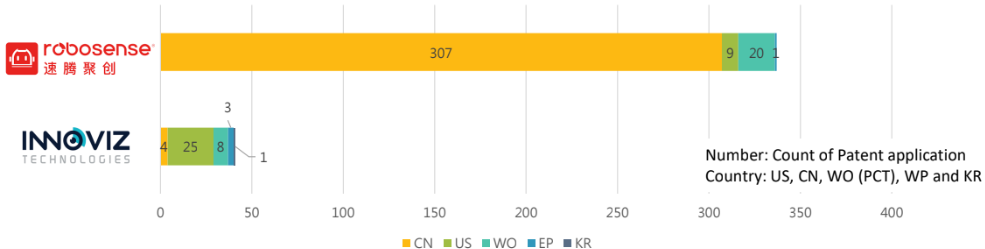

- The size of the patent portfolios:

Robosense has 337 patent applications in its LiDAR patent portfolio, whereas Innoviz has 41 patent applications in its LiDAR patent portfolio.

The size of the patent portfolio is only one of the many factors that determine a company’s technological strength. We also need to evaluate the patents’ value and quality to get an objective assessment of a company. Nevertheless, Robosense was able to build up a large patent portfolio in just five years compared with other companies within the scope of our study.

- The choice of filing country for their respective patent applications:

For Robosense, 91% are filed with the Chinese Patent Office, whereas Innoviz has 61% patent applications filed in the United States.

There are many factors to consider when determining where to file a patent, including the business objective, target market, and the ability to obtain and enforce patents.

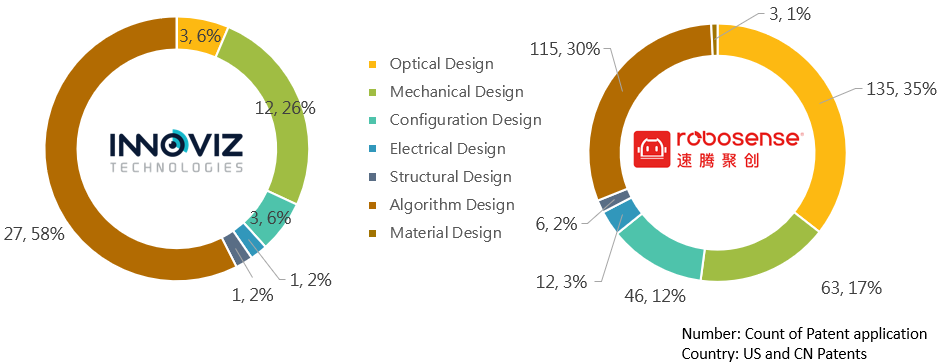

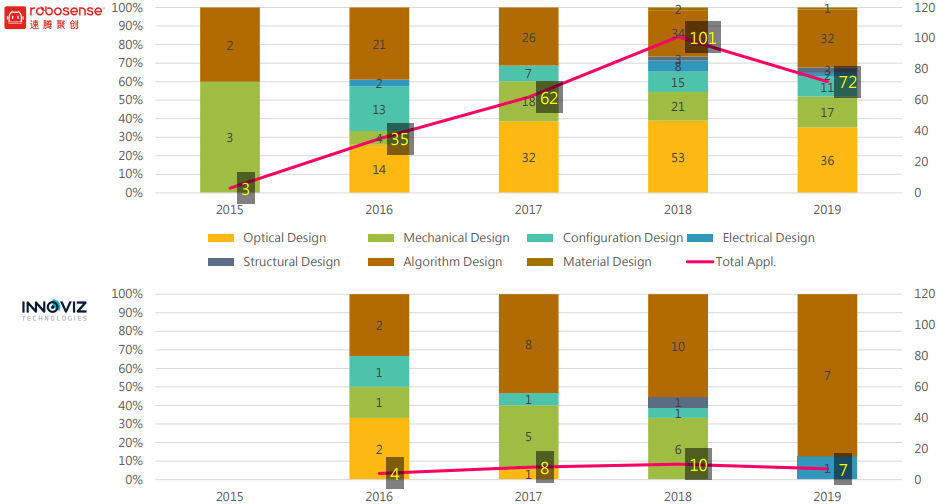

- Diversity of technology aspect:

85% of Innoviz’s patent applications are related to algorithm and mechanical design, while 65% of Robosense’s patent applications are related to optical and algorithm design.

Robosense started to build its LiDAR patent portfolio in 2015, covering technologies in mechanical design and algorithm design. Since then, Robosense has kept the diversity of its LiDAR patent portfolio along with its LiDAR patent portfolio development. However, optical design and algorithm design remained the top two technologies that have constituted Robosense’s patent portfolio since 2016.

On the other hand, Innoviz started to build its LiDAR patent portfolio in 2016, covering technologies in algorithm design, optical design, configuration design, and mechanical design, and with slightly more patents in the algorithm design and optical design categories. However, it appears that Innoviz has been more focused on mechanical design and algorithm design over the past few years.

Based on the above analysis, we can tell that Robosense has a more diverse LiDAR patent portfolio.

The technology categorization of a patent depends on the technologies being used in the claims of the patent. A patent can be categorized into more than one category.

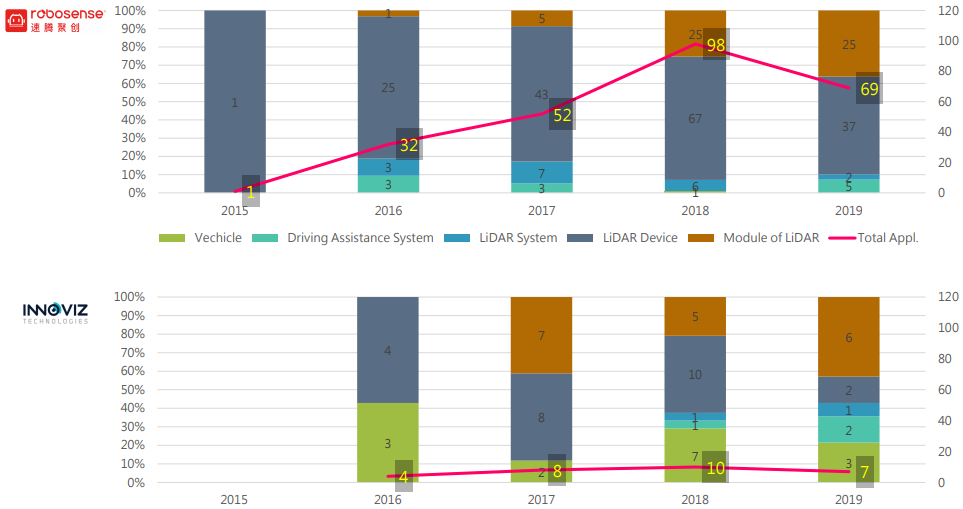

- Analysis from a product perspective:

Robosense’s patent portfolio is mostly focused on the LiDAR device level, while Innoviz’s patent portfolio focuses on more diverse product levels.

To analyze Robosense’s and Innoviz’s patent portfolios from a product perspective, we first need to understand the hierarchical order of the product structure of their products. The hierarchical order from high to low is:

- Vehicles

- Driving assistance systems

- LiDAR systems

- LiDAR devices

- Modules of LiDAR (or LiDAR modules)

Robosense has the most claims at the LiDAR device level, and it has increased the proportion of its LiDAR module-level claims in recent years. The highest product level of Robosense’s LiDAR patents is the driving assistance system. Innoviz, on the other hand, had claims covering all product levels in their patents from LiDAR modules to vehicles in the last two years. Just like Robosense, Innoviz increased the proportion of its LiDAR module-level claims in 2019. The type of product may have an impact on royalty or damage calculation during monetization, so it is crucial to have claims covered at the right product level.

Method claims were not considered for the purpose of this analysis.

Larger patent portfolios do not necessarily lead to larger investments.

To conclude, Robosense and Innoviz are very different in many aspects. There is no proof that larger patent portfolios lead to larger investments. There are many more factors that may affect an investors’ decision before signing the deal. However, LiDAR technology is undoubtedly a major topic of interest for innovators; we might be able to enjoy carefree rides with Level 5 self-driving cars in the foreseeable future.

The companies listed in the charts used for our analysis were chosen based on their size and their focus on LiDAR technologies.